Inspired by this post by Lisa, I decided to take a look at year over year spending. Since I have been tracking every expenditure in YNAB for years, I can create a decent trend graph of pretty much anything.

I am not bold enough to include totals. But I think the trends in themselves are interesting! Here are a few:

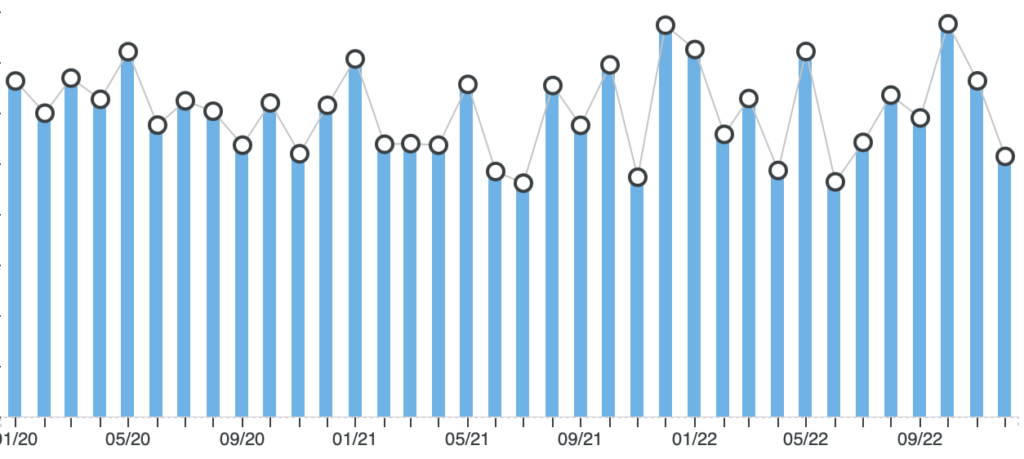

Groceries

Hmm! I would have expected more of a trend up-and-to-the-right with this one but I only see a very mild one. BUT in 2020 we did less restaurant spending so perhaps it’s just that some of our home food has now been replaced by (pricier) restaurant food.

Still though, I was pleasantly surprised by this graph.

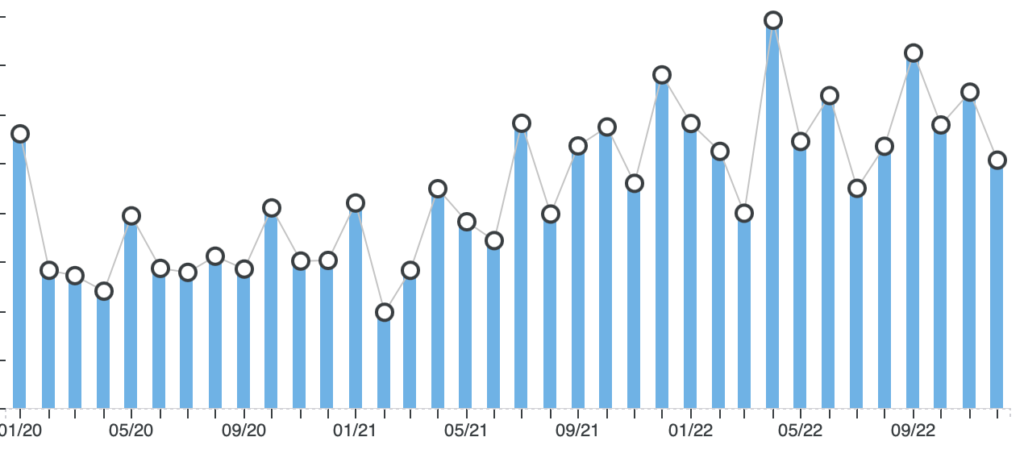

Restaurants

(This includes take out, but does not include restaurant eating while traveling — that goes into ‘vacation’ — or individual meals out/takeout for Josh or me — that is in ‘allowance’).

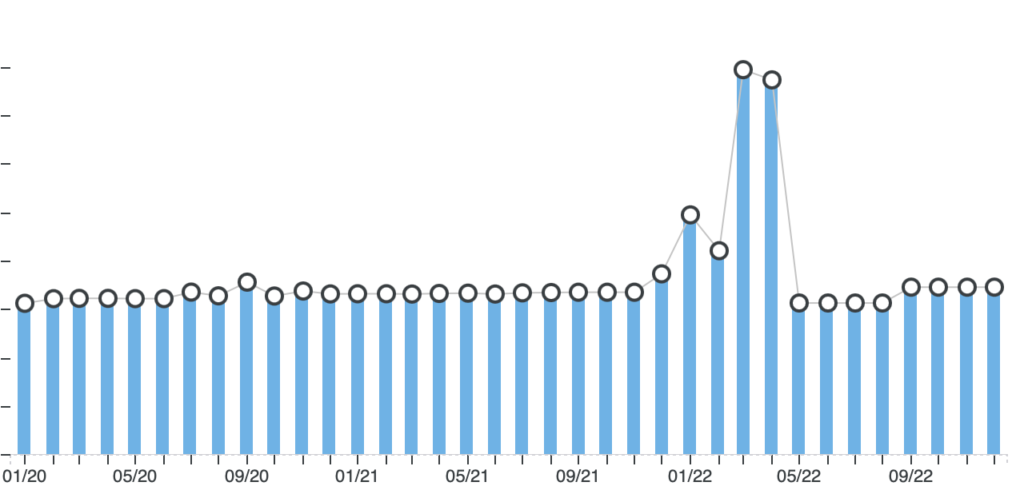

Mortgage or Rent

This is interesting: costs are steady buying vs renting (though our ‘home maintenance’ cost is now higher and that is not included here). What IS included here is mortgage payments (includes property tax + insurance payments put in escrow).

This rough months in spring 2022 are from when we were paying both mortgage + rent – ouch.

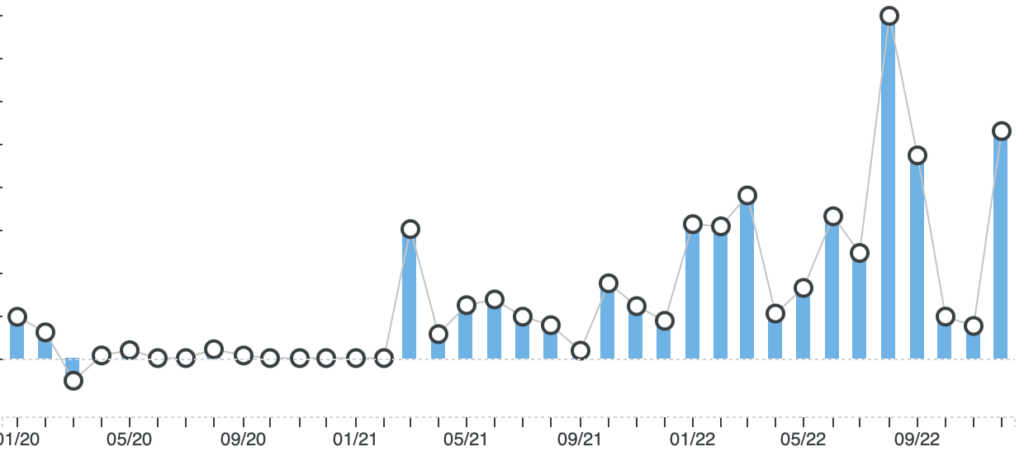

Here is where lifestyle inflation has reared its ugly head: TRAVEL

Okay, those 2020 months were artificially low (and also explain how we were able to save for our down payment). But OMG since then – wow. The astronomical month in there includes ski trip airfare + costs of some other travel (our Seattle trip).

THIS category is where I WANT to spend, honestly. As long as we are saving a baseline amount for retirement and college (more for the former than the latter, don’t worry), I am okay with our percentage spent on travel being higher than ‘normal’. But also. . . I need to be realistic. Good to see this in graphic form. If every month was like that super high one, we would . . . not have anything left.

Do you do any kind of year-end spending analysis?

32 Comments

Regarding travel, I agree with you that it’s a worthy place to spend. However, I wonder if you could do some looking at like, exactly what those travel expenses are, and if they necessarily need to be that high to still have amazing travels. TBH when I saw the total for that ski trip in one of your previous comments, I almost fell off my chair. ???? You spent more on that 5 day trip than we spent on our entire YEAR of travel, with 3 international trips and I think overall pretty epic, long vacations! And no, we don’t stay in shady group hostels. 😉 And we don’t play credit card points or travel rewards games or anything, either. I guess just maybe something to keep in mind, that there are different ways to organize the travel that maybe could get you some more bang for your buck, if that makes sense? Or, if the numbers you’re spending work for you, that is obviously okay too! Just maybe some food for thought, since I know you do not want to decrease actual time traveling (which I agree is worthwhile!) but yet you seem to like to be thoughtful with your spending.

lol. True! Skiing at big resorts is BEYOND expensive. I know. And that trip was much pricier than anything we had ever done before. If you want to ski and don’t mind things being less convenient you can definitely ski for less but . . . it was so nice, I have to say. I really want to go back! I think I could find cheaper airfare. Weird things were happening with ticket prices at the time and I bought probably too early. But things like lift tickets, ski school, a condo room for 5 close to the bottom of a big mountain – those prices are just going to be high.

Most of our trips are much lower key, though things like Disney hotel rooms (5 people especially) are $$$. We did go in 2022 and Universal as well! And we are doing a Disney Cruise next year though not planning on returning to the theme parks any time soon.

You do take some epic trips! New England and Ireland come to mind as trips I would have HAPPILY tagged along 🙂

I’ve been thinking about this a lot, too, and I really appreciate the transparency with the cost of the ski trip (I wouldn’t have known how much to guess but it was helpful to know the number!). We’re in a similar boat to Kae in that I feel like I’m happy with our travel but we do it in a very different way and consequently for a different budget…for one, we almost always drive rather than fly (including 12 hours to Maine every summer), and we often don’t do hotels. For years now we’ve done an OBX trip with other families and split a big house. We’ve started to do RV trips (rented RV) for 3-6 days in the summer. We’ve done long weekends here and there (Shenandoah, Poconos, etc.). We just did a cruise over Thanksgiving but we took it out of the local port so didn’t have to fly (but TBH, 3/10, would not recommend…not a great trip for me).

So if you’re freaked out by your numbers (which you may not be!), I think you could still travel the same amount but pick different types of trips and cut that way down. But that’s a big IF – you are obviously quite good at prioritizing and there’s no reason to change your habits if you’re happy with your savings and satisfied with what you are spending money on!

Of course, I’m going to ignore everything I said above re: vacationing for less for a (potential) trip to Switzerland this June, so there’s that =) (but just my husband and me, so cheaper by nature because only two of us!)

Chiming in here to say that there are certain types of travel (like you mention – and yes especially Disney and other theme parks) that are just by their very nature more expensive – skiing at resorts when you want to be ski-in/ski-out is ALWAYS going to be crazy expensive. Also, flying the week between Christmas and New Years will certainly come at a higher price point than going some random mid-week in a different month – but if that’s when you can go, and want to prioritize that, go for it.

that is our family’s only chance at a winter trip unless we attempt some very late season skiing (our spring break is usually april)

I think that depends…. We have never been averse to pulling the boys from school to travel, within reason, of course. Our boys usually miss around 1- 1 1/2 weeks of school per year due to travel. Fortunately, their school is generally supportive of kids missing a little school for family trips.

If I were going on a winter ski trip like that, and I was only going to go for 5 days, I would totally have no problem pulling them a Wed-Fri from school in either mid December or mid January to avoid traveling over the peak Christmas holiday rush- both for the sake of crowds and $$. We also pulled our boys in mid October one year to do a Disney trip to avoid the summer peak crowds (though is Disney ever NOT busy??….) and have pulled them the week prior to spring break the last couple years. We’ll do that again this year, too- pull them a week early to tack an extra week on to extend their spring break. That being said, my oldest starts high school next year, which will likely be a whole other ball game in terms of being able to miss school 🙁 But especially when they’re younger, it’s totally worth it. (In my opinion! Very personal choice, of course.)

We’re the same! We always pull for a beach trip in September and this year, pulled the week of Thanksgiving for a cruise. The kids only had two half-days of school M-T and were off W, Th, F, so it was kind of a no-brainer. This might get harder as they get older but so far we haven’t gotten ANY pushback from the school and we are super happy with our decision. But in a perfect world, we’d do a modified year round schedule like part of NC and AZ…I am so jealous of their ability to do longer trips at times other than spring break and summer!

okay, good point! I am not sure how thrilled the school would be but you are probably right that it wouldn’t be a make-or-break situation . . .

There’s also sometimes the random days off (why do my kids have next Monday off, for example??) and if you go on a trip near those, it’s even less time off school. I see both sides of this, and know lots of families who do pull kids very regularly for travel and it’s fine! My sister is pulling her kids for an entire week so we can go on a spring break trip together and we are leaving a few days before my kids spring break officially starts specifically because flights were significantly cheaper then.

I do get a little twitchy pulling my kids from school, so I absolutely get why people do the trips only on school breaks.

But yes – like Lori says below – skiing is just… expensive! No matter what, so if you want to do it – truly ever, even locally, you’re going to shell out some significant funds. I’m honestly somewhat glad I don’t ski, at least it’s one less person in my family to pay for 😛

AND seriously playing the travel rewards game can be REALLY worth it – we have the Chase Sapphire card and are now up to at least 15 flights from it, just in the past 2 years. I was very skeptical about doing that vs a cash back credit card but I’m so glad we did – we want to prioritize travel and it makes me feel better about needing to book 5 flights for trips when we can get them with points.

Love this discussion. I am also very pro taking kids out of school for travel. Also, we love to ski and somehow did the ski in/ski out thing for $2400 for 4 of us for 2 full days including full-day ski school for the girls just this past December. I’m now wondering if we’ve found some magical place that doesn’t exist anywhere else??!! That didn’t include food, but it did include a 3 bedroom condo (10 of us stayed there total—1 big room for the 6 kids and 2 smaller ones for the couples), our lift tickets, rentals, etc. We didn’t have to fly and it is the east coast (Snowshoe WV), but man, this clearly has a range in terms of price.

Agree with you Erin- I didn’t think the trip price was bad considering how expensive skiing is. If we do a day trip for my family of 4 skiers it’s $600 just for the lift tickets. Add in rentals, lessons, daycare for my little one and it’s over $1,000 easy for one day. That’s no lodging or flight!

Well you know I look at this annually from reading my blog. I think that monthly data is very hard to draw conclusions from – you can’t get a sense from looking a graph how your spending is changing over a full year. So I keep an eye on our spending through out the year, but I really dig into it at the end of the end of every calendar year to see what has increased/decreased. I’m happy that we have started to spend money on travel again! We don’t travel a ton – generally one bigger trip during the winter months most years. In this coming year, I’ll do one trip with my oldest and a girls trip with a friend. I imagine our travel spending will increase in a couple of years when our youngest is 4. I don’t love traveling with young kids… I know it can be done, but since we will only have 2 kids and they are close in age, we don’t have to take a big break from traveling by waiting for the youngest to be older. So it’s worth it for us. Hopefully by next year he’ll be interested in screens – then I would be willing to get on a flight with him! But at least the 5yo and I can do something fun as a substitute for a family trip.

Ahhhh I love this! Totally going to check mine out today. Travel is where we choose to spend too. Dining out has been a crutch for us and definitely an area we are working on reducing (once a week should be enough, right now we are doing more). Your groceries were decreasing there for a bit it seems. I will focus on saving money with groceries for a while but then life gets busy and the amounts shoot back up again…

Also I’d love to plug playing the travel rewards game… we did Disney twice this year staying on property once and off property the other for very little. 10x travel is a great resource for those curious, they offer a free mini course.

I’m in the camp of fewer vacations that are better fit my needs- though perhaps that’s a life stage thing. I have an almost 3 year old and almost 3 month old, and no desire for anything complicated. We’re renting a beach house this summer- and I prioritized a bedroom for each kid and something beach side (no driving or bringing everything with you). It’s way more expensive than a smaller place or something further. But honestly it’s just not worth at it this life stage if it’s not super convenient. I completely understand people wanting to stretch their travel budgets – but it’s also a question of what’s important to you on vacation. So I’m team expensive ski trip 😉

I do almost every year. Most of the categories stay the same and travel and kids activities went up since we moved to Asia. Still fully aligned with our values, so I’m fine with it.

I love YNAB and have used it for years. I have never analyzed the yearly spending because it tends to be lumpy. We save the same amount every month for travels/home improvement/etc but some years those categories build up and other times they get depleted. The monthly budget tells me a more consistent story about where our money is going (again, because the savings categories are the same even if we spend more or less in some years).

Ok I love this kind of financial recap post! I use YNAB as well and it is so helpful to see if our spending aligns with our values.

I know you are very intentional with your spending and decisions, and one thing I have wondered in some of your recent posts is how you envision your children’s financial future?

The reason I ask is because I think I grew up somewhat similar to your kids – wealthy family in a wealthy neighbourhood, went to private school, had a nanny, grew up skiing and with other extracurriculars etc. It’s interesting because almost everyone that I still keep in touch with from growing up is basically downwardly mobile financially. I mean this not at all in a bad way, everyone has the safety net of family wealth to varying degrees and mostly have very solid jobs – teachers, engineers, nurses/NPs, IT, some kind of middle management with the kind of salary and benefits that are unfortunately totally out of reach for many Americans. That being said, they can’t live the lifestyle of their parents who were surgeons, corporate lawyers, investment bankers etc.

I was talking with my sister recently about how it seems like the people we grew up with then fall into a few categories:

1. Either they have re-adjusted their lifestyle to live within the means of their salary, or live way beyond the means of their salary either helped along by their families or racking up debt.

2. Either they have come to enjoy their different lifestyle and are content with it, or they are grass is always greener bitter/unhappy about not being able to afford the types of things they grew up around. I wish I could say that was impacted by some amazing parenting lessons and that was the deciding factor, but of the families I know with multiple adult kids, basically every family has at least one kid in each camp of content/bitter and spending within means/not.

So maybe what I’m asking is – since your salaries put you basically in the 1%, unless your kids all choose one of the small handful of jobs where their salaries will be the same and more, they will probably not be able to afford a lot of the things you do, and even if they can at some point, a lot of the professions that pay that much take a long time to train in, so there would still be a gap from say 18-28 or so where they would not really be able to afford skiing, $700 concert tickets, etc.

I’m curious if this is something you and Josh think about/discuss?

Notably I think I have actually only ever seen this discussed online once – in the comments on a Cup of Jo post!

intersting. I definitely did not grow up as privileged as my kids are (nor did I grow up underprivileged – don’t get me wrong, not saying that at all!). But I went to a college with a LOT of privilege (ie: I felt surrounded by people who had grown up with more than I had) and at least at the last reunion – people generally seemed to be doing well for themselves, no matter what background they came from. Of course, there may be a selection bias of who attends . . .

I guess I don’t see it as something to worry about too much. I hope to give my kids many opportunities though there is absolutely a limit (silly example, but I am not actually sure we CAN/SHOULD spring for the T Swift tickets and haven’t actually purchased them for that reason). I hope they can choose careers they love and build a lifestyle that works for them.

And we do plan to cover the kids’ college expenses. Anything after that – possibly, but not a given.

I’m curious to know how you keep track of expenditures, particularly smaller more random ones from your allowance. Do you input what you spent on a daily basis? I think I need to start using YNAB!

enter them as they occur and do a monthly audit of every credit card statement. it’s work but I like having the data.

Do you breakdown receipts to separate out things that are just “yours”? For example, let’s say we spend $150 on nike.com, and it’s mostly some new (needed) shoes for the boys but I also order a hoodie that I did NOT “need”, but chose to buy. With my current system, I would just see $150= Nike.com and enter that in my “clothing” line as a big lump (which includes any clothing, for anyone in the family). But I’m feeling like I kind of want to break down further and be more aware of when/where I’m treating or spending on myself, or set some more specific limits. Some purchases are definitely more individual (like if I order a makeup item online), so it’s more obvious that one expense= my thing. But I guess at least for us, fairly often we have combo purchases where multiple people in my family buy something on the same receipt. Or even for other non-personal allowance expenses, say a Target receipt: do you break that down into, say, ok I bought toilet paper and garbage bags- that goes in Household, but we also bought a birthday gift for someone= gifts, and then I picked up a new wreath for the front door. Or whatever. I currently would just lump “Target” (or other similar) into a General Misc. category (which gets um, very large…hahah), but I’ll admit we have been VERY lax on doing any dedicated spending tracking really. But these posts have encouraged me to get back to doing more of it! It is useful.

Yep 🙂 if I go to target and buy $80 if kids clothes and a $10 cosmetic item I separate it out in YNAB with the split feature. I swear you get used to just doing it as you spend and it’s not that cumbersome

I will often split up items into their YNAB categories and do multiple transactions at the store to save myself the time of splitting up the one receipt myself. So if I go to the grocery store, I’ll seperate food out from household supplies so that when I’m processing the transactions in YNAB after the fact it’s less work.

For tax purposes, I run the numbers for our hobby/livestock farm. It’s in an LLC for this reason. It’s nauseating. But it’s important to my husband and teenager so I grin and bear it. I bet we spend more on animal feed than on groceries. 🙂 (It brings in some money, too, but that doesn’t touch the outgoing.)

Oh, well.

Interesting to consider!

Sarah, I am curious if you purchased vacation cancellation insurance for your ski trip, and if you did, if you could share the details.

I did not :). Living on the edge .. lol.

Indeed! That just gave me heart palpitations, lol.

We also pull the kids from school for travel as necessary; this hasn’t happened a lot because of COVID, but we even during preschool days and now in elementary school. The older they get the harder it will be for them to miss school, so now seems like a good time. Last year they missed about 10 weeks total in the final two months of school to accommodate family travel. This year they’re going to miss about 6 days!

Now that our daughter is in middle school, I suspect we’ll do it less and less, but I’m a huge fan because we can travel on the cheap and often at more convenient times for our own work schedules if we don’t go at a spring break, for example, when everyone else is likely to be travelling.

Elisabeth, wow! missing 10 weeks of school is a lot! If this happened in our school district, the kids would have to repeat a grade. Did you mean 10 days?

We have a grace period of 10 days for sickness/vacations, etc., and if the family reaches this limit, you get a phone call from the principle and your matter is handled individually. I received this phone call last year, when my son missed 11 days of school because of the tummy issues, and learned about the missing days policy.

Interesting discussion around travel/costs/etc. I appreciate this post, Sarah, and everyone who has shared their experiences. I’ve written here before that travel is not a big priority for my family right now, because I do not enjoy traveling with young children (mine are 6 and 2 now). I imagine in 2 years this might look different, so this conversation is all good food for thought as I think about where we might want to spend money/what types of trips might work for us in the near future!

This ties into the recent episode on “pebbles in the shoe” and where to upgrade. Right now I more highly priortize spending money on childcare (really hoping this also decreases in the near future though too, if we’re able to get off the waitlist and into different programs hosted by the school that are less expensive), food convenience (e.g. spending on meal kits a few times a week to cook at home), memberships to local attractions to help us survive midwestern weather, etc.