One task that has been weighing on me is our budget app.

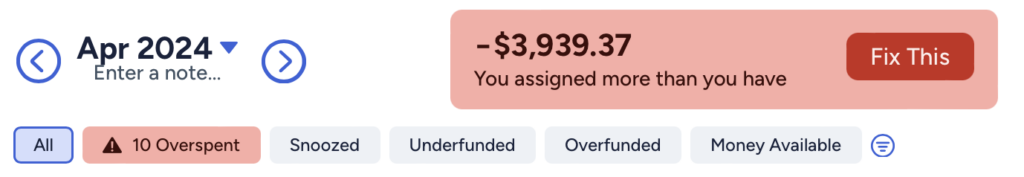

It is A MESS.

We have tracked expenses for years in YNAB — we used it in 2015-16 or so using their initial non-subscription software and then started again in 2020. We try to enter transactions as they occur, but every month I do an audit of each of our credit card statements to make sure everything is in there and correct. Sometimes I catch things like subscriptions we no longer need, and other times I’ve found outright errors (though not that often!). There is so much $ flowing in different directions that using this app really helps me make decisions about purchases AND helps me understand how to save for certain things that only come up every so often (holiday gift season, travel, camp, etc).

It works really well and I love it.

EXCEPT that I haven’t done an audit since January so right now it is an absolutely unusable mess.

TODAY I have decided will be YNAB CLEANUP DAY. I noted April 4th was empty in my planner (other than a note that Alphafly 3s go on sale at 10 am Eastern . . . nothing like spending $$$ while you are balancing your budget, huh?). And even though it will not really help with any of my loftier goals this quintile, I am going to spend the next ~3 (4?) hours fixing up YNAB. I will report back on how long it takes – an addendum of sorts!

I am curious to see if it will take as long as I anticipate or not.

I plan to keep Beyonce and Kacey in the background (LOVE both of their new albums!).

I will set an alarm to give myself a 10 minute break every hour because I think my head might explode if I don’t.

Really, I love albums in general, as opposed to playlists or random songs. I am attracted to the idea of a record player (nostalgia, though I had cassettes + CDs growing up!), but honestly I think I prefer to keep things streamlined and just use Apple Music as we have been doing.

ANYWAY. Wish me luck! Do you budget audit? Maybe I need to simplify at some points

EDITED TO SAY: DONE. Took just under 4 hours. And I did get the AlphaFlys. Which mean my allowance is 0 again, but I will be set for fast shoes for a while.

19 Comments

I don’t use a budgeting app, but I just finished up checking off my credit card statements and setting up the payments, and yeah, it’s a combo of annoying and boring. But I still do it every month. Maybe next time I’ll pump up the task with some music!

I love YNAB – it’s is really a big financial help for looking at the big and small picture. We are still using the non-subscription version because it still works for us. I try and do entries weekly as part of week review and consolidate at least once a month. I automate the recurring entries as much as possible (mortgage/insurance etc). My audit strategy is checking if the spending aligns with our values mid year and year end. And from there, we fund categories based on our week review/yearly planning – i.e. milestone anniversary coming up so assign some money to the category. The best part is the year end – seeing the overall picture and having data on the household finances is always satisfying so I keep up with it. I like your strategy – keeping it fun, whether with music or snacks, is key!

We used mint in the past which moved over credit karma. There isn’t a lot of work that needs to be done. I try to keep an eye on things flowing through so they are properly categorized. We mostly use the summary of assets for our quarterly financial reviews where we look at our investments and figure out what changes will need/where we should deploy cash. So our approach is one that won’t result in changes in behavior, but there aren’t any spending changes we want/need to make because we spent a fraction of our incomes and are just naturally frugal by nature. I can see the benefit of YNAB if you wanted to make changes in how you spent your money or had a tighter budget to work with, though. And I totally acknowledge that we are lucky to be able to live under our means… we got lucky that we work in well compensated industries. But I think our spending is really low for our peer group, or that is what the FA we met with told us in 2020 when we did a financial review.

I’ve been using YNAB for years, too, back when they still had (and supported) the desktop app (which I miss!). This is probably the…5th or 6th budget I’ve created. Previous attempts always failed when I found myself so behind on updating it that it made more sense to just start over, but so far I’ve been on the same budget since August 2021 (!!) and have been able to keep it up fairly well, so yay me!

I *try* to “balance my checkbook” (what I call updating the budget, reconciling it with credit card statements and the bank account; I don’t auto-sync the banks as I tried that once and it was needlessly complicated to reconcile) at least once a week, but every now and then I find myself facing 2-3 weeks’ worth of income and purchases missing and I spend an hour or so catching up. Especially if I’ve been traveling (whether for work or pleasure), I can get behind pretty quickly.

Still, there’s something deeply satisfying about doing this work, and I too put on a playlist to make it more fun! I hadn’t thought about playing Beyonce’s latest album — what a great idea! I heard a review of it on NPR yesterday and loved the clips they played.

I actually do have a record player and probably 200+ records, but I mostly do that on weekends, when I’m just chilling on the couch in the living room. When I’m working in my home office doing home administration, it’s all Spotify.

OK I am really curious as to what your audit entails. I use YNAB as well, but it syncs automatically with all my credit cards and debit card so I just periodically go in and categorize expenses…. but mainly it does all of the work for me. Maybe once a year or so I reconcile my account balances just to make sure that everything is correct. The one piece I DO need to do is the budget… which, if I’m going to be honest, I don’t really use. (I guess I use YNAB as more of an expense tracker than a budget, per se.) Sooooo- what is it exactly that you are auditing?

mine doesn’t sync!!! i go in manually. so, i look at every transaction. maybe i shoudl change it but i kind of prefer actually being forced to look at everything . . .

Budgeting is something I think we “should” do – but honestly, it’s not how my husband operates, and I’d try to be perfectionists about it, so I’ve let it go. We save a large portion of our income without even trying (yes, privilege in that comment) so I’m not sure I see the point for us. I’d like to do a better job of tracking charitable giving and increase that though.

Ahhhh ok that makes WAY more sense. That seems like a lot of work! Maybe try the syncing and see how you like it? I would think it would be a big time saver, and you would still go in each week/month to review and categorize new transactions

re: albums – the new Vampire Weekend album comes out tomorrow if you haven’t already added it to your list!

I use YNAB, and I find it extremely helpful in planning out expenses that happen occasionally, but where I absolutely need to be prepared. I set aside for special occasions and gift giving, for vacations, activities for the kids including summer camps, etc. I am currently saving up to buy a home, and I will need to be able to cover all the related expenses myself since I’m divorced, so that factors into my saving and spending goals at the moment. I enjoy keeping track of my expenses and check on everything in YNAB daily. I’m a bit obsessed with it!

I use PocketSmith as a budget tracker but I only budget for certain categories, eg. utilities, medical, education, kids activities, subscriptions, beauty. The everyday living & food shopping are not budgeted. There is a pool of money from each pay which is kept in a different account to cover this. If it starts to look low we just pull back. I tried budgeting and tracking those more intensely but just found it too much. For tracking transactions I use the sync feature on PocketSmith then I manually categories each transaction (rather than setting rules). I find this is enough of a prompt for me to pick up unwanted subscriptions, random spending etc.

This is interesting….I.do not budget. I have never had a budget. Nor do I have any debt other than mortgage. I don’t have a partner, don’t have extravagant expenses, and have a pretty intuitive sense of what I “should” be spending and can be spending as salary has increased over the years.

I am a natural spender so I need it 🙂 totally see how if you are inclined to save or under buy less important! We track net worth and investments too. I need the feedback and it does change my behavior! (Ie if allowance is empty – I will wait to buy. Or we will defer things like getting new car etc.)

I love YNAB. I’ve always been a bit obsessive about tracking my money, so what it really did was save me time. Instead of going through all my receipts and bills on Sunday and taking several hours to update a crazy excel spreadsheet, now I enter in every transaction on my phone manually as it happens. Then I reconcile every morning – if you do it every day, it takes 2-3 minutes max. Then once I month I allocate my pay – 15 minutes tops. Not sure it’s saved me much money but it has saved hours and hours of time and aggravation!

Interesting about the daily checks!!! I did a monthly audit but considering change to weekly …

Any financial insights during this auditing journey?

1) our grocery spending is wild and we need more Trader Joe’s

2) need to make sure we save before traveling again and probably not travel for winter break if we are going to in the summer

3) my running habit consumes my entire allowance right now between coaching and shoes and other sundries

I read a whole finance book on Monday (my husband decluttered it and I was like, wait, I haven’t read that yet). Anyway, in it she was talking about aggregators and I remembered that I was a beta tester for an app a million years ago (about 12 – 13) so I tried my email and lo, it still worked. Took about 20 minutes to remove old accounts and add one or two more, and I’m back in business.

This app (22Seven) checks all your transactions and allocates them to categories and gives you amazing insights and reports. I am again hooked!

very cool!!!!