We are not homeowners!!!! We are not homeowners!!!! We may never be homeowners again! And I am thrilled about it.

Yep, we sold our house on Tuesday (ie, we closed) after a mere 367 days on Zillow (or thereabouts). We sold it for significantly less than we purchased it for 6 years ago and had to write a sizable check (that we had been saving for, knowing our day of reckoning had come) to seal the transaction. But we did it!

Will our taxes go up next year? Yes. Yes they will.

However, we will NOT be paying any:

- mortgage interest

- mortgage payments

- property taxes

- homeowners, wind, or flood insurance (the wind insurance costs were staggering in Miami Beach – something like $7K/yr for a plan with a $50K deductible!!)

- (yes, we pay renters insurance instead but that’s not a large cost)

- potential ‘assessment’ costs

And OMGGGGG. The feeling of not having any stock in the South FL real state market (ahem climate change) is amazing. So amazing that we were at peace with writing that check to sell.

(At the bank, the woman helping me wire the funds was very confused that I was wiring $ to sell and not buy. Yes, that’s going to happen sometimes!!).

If I am wrong and housing prices soar in the next decade — I’m completely okay with that. Because not taking that gamble anymore is worth it.

Lessons I learned from taking a loss on a house (TWICE – this also happened to us in 2009 on a smaller scale)

- Don’t be too proud to consider the first offer. We were insulted at our first offer which was . . . approximately 40K higher than what we sold the house for, 10 months later. Double oops.

- Don’t buy unless you KNOW you want to be in that house (and that location) for 10+ years.

- Homes cost way more to maintain than most people think. Do not forget: exterminator costs. Lawn maintenance (time or money). HVAC systems (we paid to fully replace ours in 2017 – agh). Appliances. There is so much that can go wrong in a house.

- Don’t assume that you know what it’s like to live somewhere just because you know what it’s like to visit

- Don’t be afraid to calculate the costs (and mental stress) of renting vs buying. YOU DON’T HAVE TO OWN A HOME TO BE A GROWN UP (or to grow your net worth). This 2014 NYTimes article with calculator is getting older, but it’s fascinating.

With renting, you don’t really get to decorate your house and it doesn’t make sense to spend a lot of $ or time upgrading. Which for me — is an enormous positive! In fact, I greatly appreciate having the excuse to spend basically zero time decorating/improving our home. I was born without the gene that causes one to want to spend time thinking about countertops and window treatments. I want clean countertops, but it doesn’t bother me if they are Formica.

When you rent, you also get to call someone else and have them fix it ON THIER DIME when something major breaks. Is it always seamless? Absolutely not. But in our experience, it’s been pretty decent. Our rental turned out to have termites (in S Florida, everyone has termites at some point or another) and they tented it and covered hotel costs. If a hurricane comes and sweeps our roof off . . well, it’s not actually our roof. There is much less unexpected to go wrong.

And for me, that peace of mind and predictability is worth rental costs & a bigger tax bill. I don’t see us ever buying again unless we find ourselves in a location where a) we know we want to live forever and b) we feel confident about the stability of the market given environmental concerns. (I DO have a fetishy desire for a log cabin in Vermont sort of as a “just in case” investment, but I doubt Josh will ever be on board with that plan!).

The thing that Josh and I have been surprised about is how few people seem to feel the way we do. It seems like there is pride in home ownership and maybe even some shame or at least some lack of status in renting. (And somehow this does not seem true for cars – which we do own outright, but so many people lease!).

Anyway, whatever. We are thrilled to be renters. Here’s to a debt-free 2020!!

21 Comments

Haha, I was also born without the decorating gene. My husband and I usually get around to home improvements and decorating when we’re ready to sell the house. YAY for finally being done with yours! We rented for a year when I was pregnant with #2 and it was amazing. The a/c kept going out in July when I was 8 months pregnant and all we had to do was call the owner!

Solidarity! Our family has also come to the same conclusion in the renting versus buying debate. Every time we run the numbers it just doesn’t pan out. Especially because in order to buy in Southern CA we would have to accept long commutes, which is just not how I want to spend my time. Renting allows so much more flexibility and, in our case, we get to live close to work, in our favorite city, and close to wonderful schools, including our beloved full time day care/preschool.

PS – like your Vermont cabin dream, we have also discussed about buying a vacation home somewhere wonderful instead – and maybe we will!!

Congrats on selling your home. It’s tough to bring a check to closing but must feel great to have that house off your balance sheet. I almost had to do that with a condo I bought in 2005. I sold it in 2018 and got a small check at closing but, in total, I lost on the deal because I sold it for $15k less than I paid for it in 2005… but my mortgage was paid down enough that I got some money at closing. But that was an awful investment and I learned a lot from that buying process!

We are team own but we know we are going to stay in this area (Minneapolis) and were very particular about the neighborhood we bought in. It took us over 2 years to find our house as we held out for something that was perfect for us. We were told by many people that we were being too picky and that we’d never find a house – but our patience paid off and we intend to stay in this house until we retire and downsize! We are going to make quite a killing on the sale of the home my husband bought 6 years ago, but it’s a first time home buyer house. We are selling it for 40% more than he paid for it which is batsh!t crazy, but it’s in a great area and was remodeled very nicely by a previous owner so it’s a gem of a house. The first time home buyer segment of our market is just nuts since there is very little supply and a lot of demand. The house was great but it was just too small for us at 1300 sq ft.

The main reason we want to own is because we intend to pay our house off very quickly – within 5 years – so that we have a lower cost of living. My husband and I both work for asset management firms and there is so much volatility and a high chance one or both of us will get laid off in the next 10 years. So we feel better having lower living expenses in the event we are missing one income for awhile. You and your husband work in jobs that appear to be more stable and always in demand so I can see how lowering your living expenses is less of a priority for you! There is right decision for every person/couple – it just depends on what you value. After being stung on 2 sales, I can see why you don’t have any desire to buy another home!

Congratulations on selling and on going into 2020 debt-free! Double exciting!!

Yes, congratulations!! That must have been stressful to have the house sit in the market that long, but it sounds like you have had a great attitude. We got burned on our house sale in Richmond, VA in 2011 (we bought in 2007 – dumb, but everyone was telling us to buy and I loved the idea of owning a home…). We’re in the DC area now and our house value has gone up quite a lot, so even though we took a loss the first time around we’re “ahead” now. I do agree that home maintenance is a huge pain and sometimes throw up my hands with how much it all costs and the unpredictability of it all.

I laughed when I read the “no decorating gene” – this is so me! I bought a house last year, and we had friends over ~a month later. A couple of them have mentioned that they were excited to see our house when it was “fully decorated” and “done”. I chuckled then because I didn’t think anything would magically change… it’s just not something I care about!

We’re a 1.5 years later, and the only “major change” was adding a family portrait to the staircase. And even that was completely my husband’s doing.

Refinance the mortgage? Get the gutters cleaned? I’m on it. But I’m just not into decorating! I’d rather admire other people’s great work at their houses.

Yes girl, YES. Thanks for the reminder that if/when we move, we do not have to buy. In fact it may be better not to. Owning is such a freaking pain.

I’m single and a few years younger than you but you list so many of the reasons I’m okay renting! My dishwasher started leaking the other weekend and my landlord fixed it (and a few other things I had been too lazy to tell him about). If something happens and I have to “downsize”, it’d just be breaking the lease and moving costs, not having a house to sell. And honestly, I don’t care what my kitchen looks like either.

I actually did take a first time homebuyers class a few years ago and I’m glad I did because I had no idea all the things you pay for when buying (I thought it was just down payment and a mortgage, which I think many do think at first!) and also made me more educated about the pros/cons of homeownership.

Congratulations! I think this is really good advice. I always remind people of all the downsides when they are thinking of buying a house for the first time.

Honestly, I’m jealous. Where we live, housing prices are completely dictated by the quality of the school district, and there are very, very few single family home rentals and those that exist are not long term. We only bought to have the peace of mind that we’ll be able to send our youngest (now 4 years old) all the way through high school here. We sold our first home for almost the exact same amount we bought it for 9 years prior and I would love to never have to sell a house again.

Yay! Congrats! What a weight to have lifted off your heads. And yes, I too am without the “decorating gene”. If/when we move I also want to consider renting.

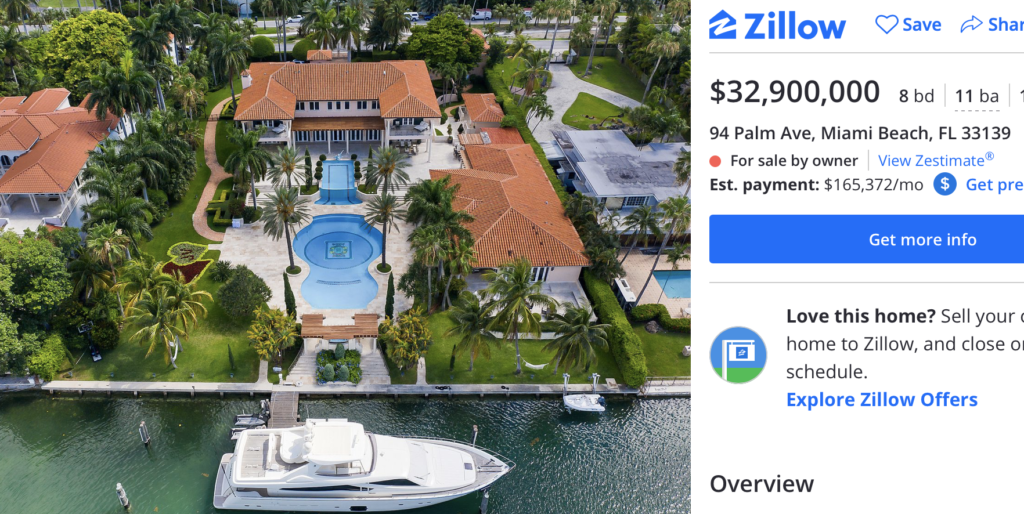

Congrats! Interesting discussion re: renting vs buying. We live in a suburban community where most people definitely are homeowners and I know what you mean- I think some people would “look down” on us if we “just” rented. I feel like around here, there is a lot of pride in having a relatively fancy home. My husband and I discuss it all the time. We can’t even figure out how some people we know are affording these big new homes. We personally chose to stay in our older, quite modest 4 bed, 3 bath ranch, in an older, simple neighborhood, and remodel a few things instead of trying to upgrade to a newer neighborhood and make our finances uncomfortably tight. Heck, even the remodel is so expensive as is, and it’s still less than if we had built/upsized! I still sometimes struggle with feeling “inferior” in a way when my kids’ friend’s parents drop them off/ pick up at our house, wondering if they think our house is too old or small compared to theirs. But it works for us- we like our house a lot and have made it our own over the years. We did a LOT of looking before choosing to remodel, and never could find anything that actually ticked all of our boxes as much as our own does! (in our price range). Maybe that $32 million one you posted would do the trick though! 😉 Only a mere $165k per month mortgage!! OMG.

Seeing that your house sat on the market for a year, did you ever think about renting it out to let the market recover rather than letting it sit empty? We had a house on the market from July to December 2018, and finally we got a tenant in there (for less than the mortgage) in January, just to try to mitigate our losses somewhat. Now we’re in the same boat, of do we rent out for another year and likely face the same market conditions a year from now, or do we sell for whatever we can get and just plan to write a five-figure check? It’s tough!

Congrats on the sale! Great discussion here. After 12 years of renting, I LOVE being a homeowner. We moved from San Francisco to Denver last year mostly for a better quality of life, but also a big factor was that we could afford to buy a home here. SF is insanely expensive and we couldn’t afford to buy anything (and could barely afford to rent our apartment). Now in Denver our mortgage on a 4 bedroom house is less than our rent was on our 2 bedroom apt, and we have such a better quality of life. In SF our landlords were terrible and never fixed anything on time or very well. We also had tons of issues with noise, crime, etc. despite paying astronomical rent prices. Now our home life feels so much calmer and happier. I also have the decorating “gene” so it’s been really fun to spend time decorating the house. Also house prices are going up really quickly here so I feel like it’s a worthwhile investment. We could never afford to buy in SF, but had friends that scraped by and got in early and made a huge windfall when they sold, even after 3-4 years. I know that SF is an anomaly but it’s still interesting to think of real estate not being a good investment everywhere.

I love how honest you are. I learn a lot from you! Do you have any advice on starting from scratch in trying to get organized and make routines?

Ah that’s great news :). I’m glad to hear you have that off your shoulders!

Where I live, renting is not an option, buying with a good cashdown make you save a lot of money. And here, the market is so good that the value of our house is up around 15% in 18 months… Owning here = better than stock market haha.

Someone might have said that about Miami Beach 6 years ago, too. Just remember a healthy market isn’t always a guarantee it will be like that forever (of course … it also might! But it’s not a sure thing).

Yes I get what you said, always be careful is the key, and a financial adviser huhu. (But our city is quite small, with a lot of governmental services, a quite big hospital, big army college and a ivy league university who is in good position on lists… so all signs of durable economic growth. The only thing that could go wrong would go wrong for everybody: climate crisis. This will change economy…

I know this is an older post, but I could relate to many of your feelings so much. I also was born without a decorating gene, and when I listen to my peers discuss home remodeling plans and upgrades, my eyes immediately glaze over. I have never been interested in owning a home but did so twice– long story. Now my ex and I still own our house and rent it out, and it is a constant worry in the back of my mind and will be until we decide to finally sell it. I don’t ever want to own again, either. Been there twice and don’t care to repeat again. Thanks for writing this! And yes, I agree, few people, especially in the U.S. feel the way we do… but oh well. To each his/her own.