Housekeeping

1- Remember, you can submit audio questions! I would love to hear some of your voices!

2- Apology – A listener pointed out: “In episode 12, you were referencing the yearly calendar and holidays listed. And mentioned some holidays were non traditional, non American holidays and then went on to list Jewish and Islamic holidays as examples.

To say that these holidays are non American is rooted in the belief that American is white Christian nation only. This is extremely othering and not at all inclusive too many in this country.” I appreciated her bringing this up and wanted to offer my apology — I definitely did not intend to exclude but my language came out that way, so she is absolutely right! For the record, I generally believe that the more holidays and traditions a given planner product shows, the better!

Organizing Your Financial Life

Ways to be intentional about your finances:

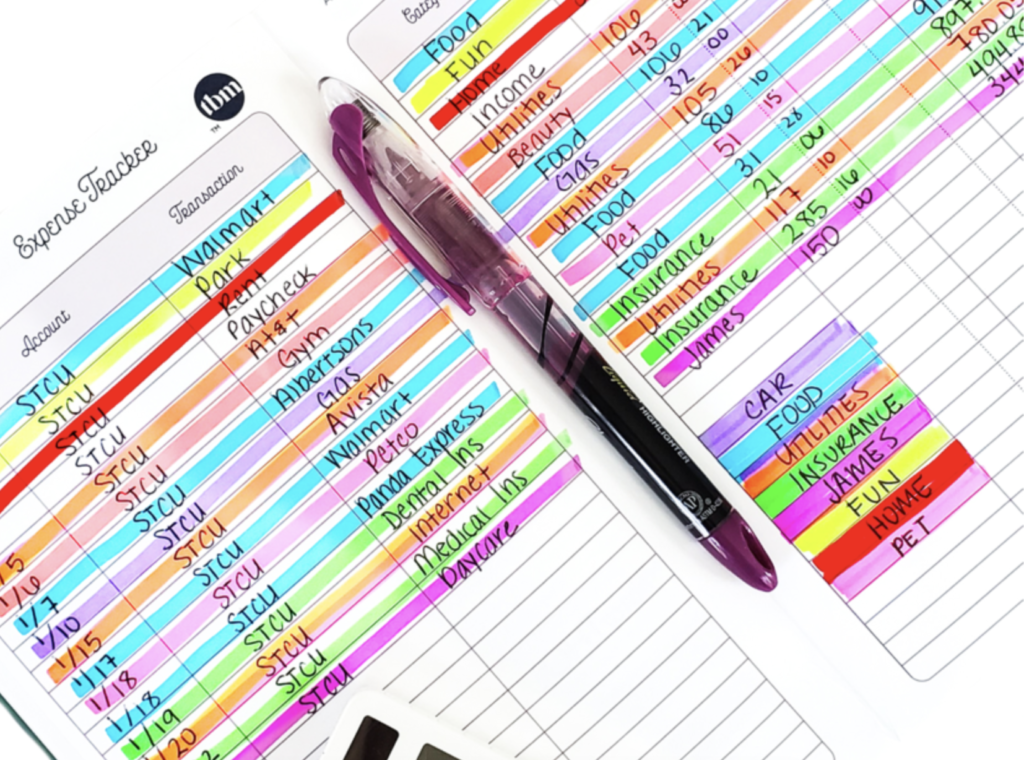

???? You have to know what’s happening with your own day-to-day cash flow. In our household, we use You Need A Budget (and I love it!). Others prefer Every Dollar, or an excel sheet, or even a paper option like those from The Budget Mom or EC’s Budget Book.

???? You have to learn about finances! There are so many different resources! Feel free to share your favorites below, or let me know! Two that were helpful to me are: Your Money or Your Life by Vicki Robin and The Physician Philosopher’s Guide to Personal Finance by James Turner.

???? You have to look at your own finances every so often. We calculate our net worth every quarter and fill out current balances into a master excel sheet. It’s nothing fancy – just a list of all our accounts & totals at the bottom.

???? You have to consciously think about and edit your goals! How much do you need to retire? When do you want to retire? What will your ‘policy’ be on paying for kids’ colleges? How about professional or graduate school? What do you think your expenditures will be when you are older? ALL important things to think about, evaluate, and re-evaluate along the way. Some interesting calculators to peruse are on Choose FI and Mr. Money Mustache.

(I am not affiliated with any of the above products or links!)

Feel Free to Share!

Anyone else a ride-or-die YNABber? Do you have quarterly, yearly, or monthly meetings with your partner? How much of your financial info do you discuss with your kids?

Episode Sponsor

I think I said last week that this was the last mention of Lani’s course – but it’s this week! So much for impeccable planning . . . ha!

Please take a moment to check out this episode’s sponsor, Real Life Style! They are offering a fantastic e-course that will help you revitalize your work wardrobe, and you will receive a free Zoom Q&A call upgrade if you mention signing up via Best Laid Plans! Check it out at www.real-life-style.com/bestlaidplans!

PS: Back with more tomorrow. I really did need that break, though!

11 Comments

????♀️ Fellow YNABer here! I love their reports and how easy their app is to use.

I would highly recommend a personal finance book called I Will Teach You To Be Rich by Ramit Sethi. Cheesy title, but it really helped me understand long term investing, especially the importance of fees. He’s also very funny, and I always find it helpful when a book on a dry topic injects humor.

Loving the podcast, Sarah!

The Afford Anything podcast is one of my favorite financial learning resources. Happy Money is an interesting, relatively short book on the psychology of happiness as it relates to money, which won’t help with learning about planning but helps think about how best to spend money.

Most people have probably heard of this, but I love the app/website Mint for tracking spending. It is automatic, connected to my credit card and other accounts (even venmo!). It even automatically categorizes most things, though I review monthly and make some edits.

If you are interested in more details on budgeting and other money questions, I have really enjoyed the podcast Fiscally Savage and there are resources on the website (https://fiscallysavage.com/), too.

Now a die-hard YNABer (having followed your recommendation a few years back). We have a short monthly chat as we set the budget for that month. Then we tend to have more lengthy chats every six months or so to check what our intentions are and how we are meeting them.

We bought subscriptions to YNAB for our two sons as they started to manage their own finances.

oh that’s so smart! I am sure it will help your sons. I WISH I had YNAB much earlier!!

I also use YNAB and it’s been great to get my husband and I working together on financial goal. I find it very intuitive to use and switched many years ago from Mint to YNAB. Never looked back.

A book recommendation: What Matters Most by Chanel Reynolds really helped us do estate planning. It’s not fun to think of but her story of living through loosing a spouse was a helpful kickstart to many important conversations between my husband and I-way beyond the normal financial docs we thought we had under control/ready.

Thanks for the book rec, Leah. I’ve been looking into this topic recently as I need to get started on estate planning. I should have done so years ago, but better late than never!

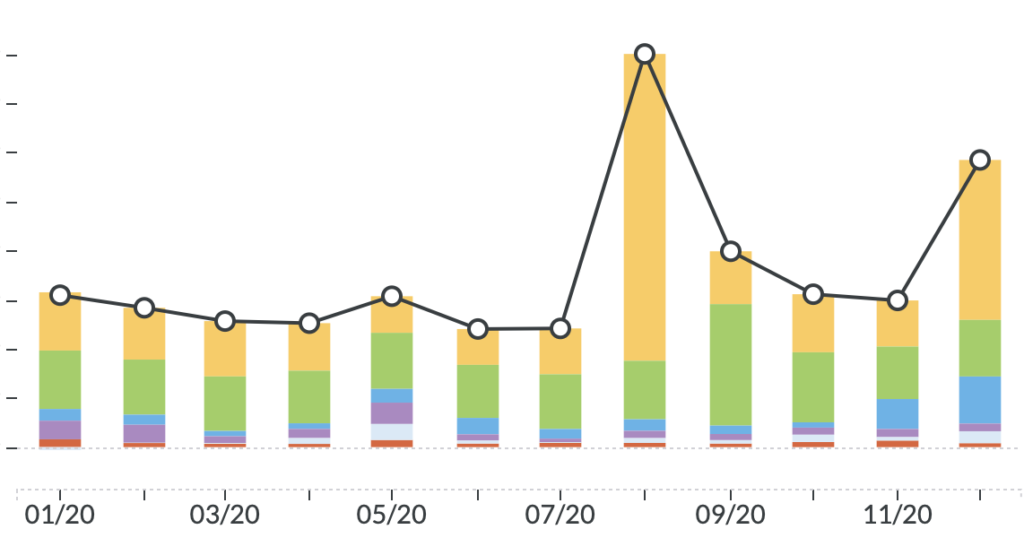

Finances are my favorite topic! We too use YNAB, though I use it primarily for after the fact reporting on our spending rather than as an budgeting tool. I find it less cumbersome than mint, and worth the $50 I spend on it annually. My husband hates anything related to finances and hands it all to me to manage (even though I routinely tell him that he should pay attention because I could be cheating him). I have gotten him to agree to one financial planning meeting annually, where we review our spending from the previous year. We go category by category and see what we spent, how it compared to previous years, and ask whether we’re okay with it. If we’re not, we brainstorm ways to bring the number down, and set numbers for the upcoming year. We also identify key needs for the upcoming year – like the year we were pregnant we planned to replace our phones and computers which were very old (10+ years for our computers!) and easier to replace pre-baby. We also use the meeting to set very big financial priorities for the upcoming year. Our first year out of grad school, it was building good work wardrobes. Our second year out, it was saving up to buy a house and to buy furniture. The next year we prioritized home decor. By year four my husband was super antsy about not having left the country for years, so travel was our priority that year – we went on three international trips after making that plan. Just having the annual priorities conversation has been so helpful. I do all of our household spending, and that conversation “pre-authorizes” me to spend in accordance with the plan without having to check in with my husband on every individual item. There’s no arguing about spending too much on a sofa when we’ve already planned to prioritize our spending that year on home decor. I don’t value travel as much as my husband does, but in the years that we specifically plan on going big on trips, knowing that it’s just the plan for that year makes it easier for me to accept. It has worked out great.

The other very helpful thing we did was to hire a financial planner to do a one time review of our whole financial situation, talk through recommendations in key areas (insurance, savings, retirement, etc). Since I had been managing our money on our own, and my husband wasn’t capable of being a sounding board, I wanted more confirmation that I was steering us in the right direction. I was, but she also made very valuable tweaks to my investment portfolio which have more than paid back her fee (around 1K, which was a friends and family discount as she’s longtime family friends of my inlaws). She also recommending upping our life insurance, which I had made reasonably educated guesses about, but neglected to consider inflation (d’oh!).

In addition to actively managing assests and doing big picture portfolio reviews, our financial planner will also advise on a specific financial project/goal. I think we need to reach out again to see if we can get a review of our financial planning for our daughter, who may possibly never live independently. As of now, we’re putting money into a 529 for her knowing that we can transfer it, in small chunks, to an ABLE special needs account. But this way we hedge our bets now that some kind of higher education may be possible for her, or maybe we spend it on special needs private schools (one change from the Trump tax cuts that could actually help us out). We have our house on a payment schedule that has it paid off when we’re retirement eligible, then we would live off our pensions (not actually a significant decrease in our quality of life from what we spend now, esp if our housing costs are very low annually) and not touch our invested retirement funds. We’d save those for our daughter after we die, with the hope that they would generate enough income to ensure she doesn’t live in poverty. It’s kinda hard to feel like I can adequately plan for the next 90 years (who knows how long my child could live, if she makes it to adulthood???).

I love these ideas! Thanks for sharing.

Also, it’s crazy to have even more to say after that mini essay, but the FIRE movement really rubs me the wrong way. It seems so joyless and ascetic to me…

Loved this episode as I am a finance geek! My husband and I both work in the financial services industry so it’s natural for us to be interested in this topic. We use Mint but I can see how it is less helpful than YNAB. I mostly use it to see trends in spending, especially year over year. It’s also nice to have a snapshot of all our investment accounts. We meet quarterly and look at the balances/talk about an investment plan for money we want to invest. As another person said, we also met with a financial advisor last year so he could run some projections on how much we should aim to have in retirement accounts and how long he thinks we both need to work. We don’t plan to retire super early but we work in a really volatile industry so it was helpful to have an unbiased assessment of our financial health. We are knowledgeable about investing but you need really sophisticated software to make projections about how long your assets will last. It was free through my employer but would be worth paying for in my opinion.