I have been thinking a lot about the FI movement and how many people might be feeling now that their nest eggs are likely shrinking.

(Hopefully temporarily, but still!)

I have also been thinking about how much easier it has been to work with just one child at home. There was a point when I think I had the idea I might try to retire somewhat early, like mid-50s. Now I’m thinking – 65 seems early enough? It’s true, it is hard to know how my mind and body will feel at that juncture. But currently I can envision a future where Josh and I work until around that age, with part time work (potentially for both of us!) playing a role at various points along the way.

And finally, I have been thinking about mortality and the memories I want to create as a family. Or things I just want to be able to look forward to and enjoy while they are happening!

The things I WANT to spend on: travel + experiences + kids activities + childcare + education + camp. Also good quality food. Really, those are a lot of things and so of course they add up. Especially travel lately, which is probably good from an environmental perspective but there is an element of sticker shock — flights that used to be $200 are now $400 and so on. Multiply x 5 and . . . wow. It doesn’t mean we won’t do it, but it means thinking harder about which trips are priority and what tradeoffs need to be made. Keeping some trips closer to home helps — our Amelia Island week for example should be pretty reasonable (though we made it significantly less reasonable by adding on a day at Harry Potter/Universal). We did pay for our VRBO, but the beach is free! Using rewards programs and credit card points (ie Marriott Bonvoy, Chase Sapphire Preferred) helps a little bit. I need to be better about signing the kids up for frequent flier numbers — over time their flights will add up!

I know we also definitely don’t need to travel for every school break. I guess it helps that sometimes we have to work, but then again I feel like that might increase the pressure to make non-working holidays extra special.

Things I still have zero desire to spend on: home expenses (our mortgage is reasonable and I do not see us ever moving unless it’s out of state or to downsize once kids are grown), furniture/decor, fancy designer items, cars. Also crypto/NFTs/metals/individual stocks, lol.

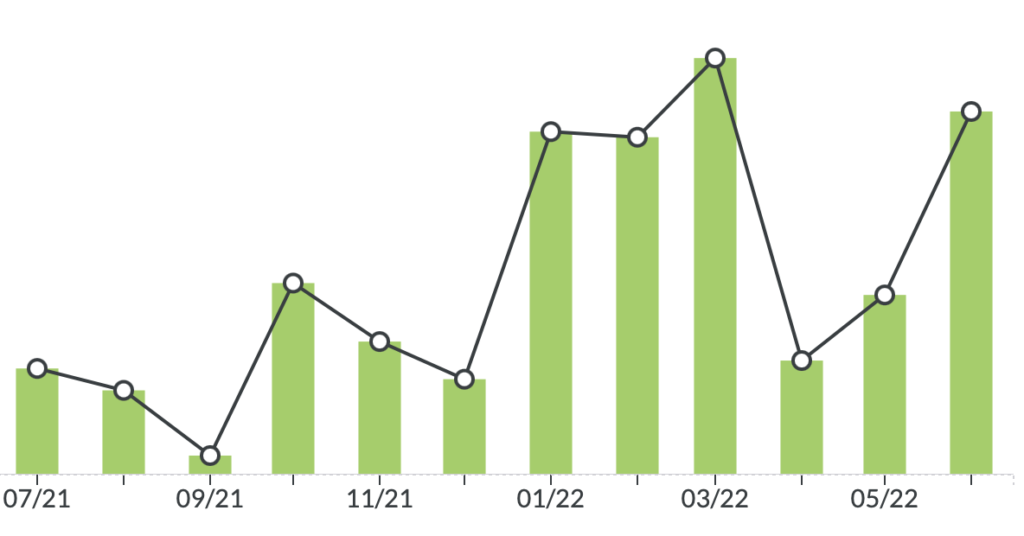

I wrote about this a year ago, and since then our expenses have absolutely increased, and our savings have been less aggressive. We are still doing the autopilot pre-tax savings (403b + 457, which is about a ~15% savings rate) but kind of stopped going above and beyond that for right now; I feel like we are also still regrouping from our move and minor reno/repairs (floors, paint, fixing the #%(@&$ roof). I’m honestly kind of ‘meh’ about the savings piece, but also somewhat nervous about inflation continuing. I guess we will just have to see. And also work on where we can spend a little less OR earn more OR both.

Questions to ponder:

- Has anyone else re-evaluated retirement age plans?

- What is the spending category you are LEAST likely to want to cut down? Mine is probably travel, honestly . . .

- What are current areas of opportunity to cut back? We could definitely do better with food (need to try Aldi and make better use of TJ’s; could definitely get less delivery) and generally buying fewer things.

Necessary notes: I fully recognize the inherent privilege in this post. I know there are some who have had to eliminate almost all travel and extras. I also know many people IRL who can (or at least it appears) go wherever they want, whenever they want without making a dent. I know when I write about money it can be sensitive, yet as a reader I wish more people in every tax bracket would write about their spending and choices. So I hope it is okay with most!

51 Comments

I always assumed I’d work into my early 70s — I work in academia and really enjoy being in the classroom and doing research! But I’ve found, especially after the last few years, that while I enjoy the work, the workload is crushing and, sometimes, soul-sucking. (The pandemic exacerbated this, but I think it started before the pandemic, honestly). So now I’m looking at maybe semi-retiring in my early to mid 60s and consulting after that. Ideally I’d make this move in my very early 60s (so, about 10 years from now), but I’m looking at 2 kids in college in the not-so-distant future (I have a 6th grader and a 10th grader) and I would really like to take advantage of the tuition benefit my job provides!

Yeah….timely questions for me. Some major changes: although my university had salary cuts during the pandemic, my salary has still gone up somewhat significantly over the last five years. I also now have a kid starting college (OMG). Still trying to get the max into my retirement, as I’m turning 50 this year (also, OMG). At this point I can imagine retiring the usual ~65ish, perhaps a few years earlier. I don’t imagine going much later than that; I enjoy my work overall but imagine I’d be happier out of the classroom at that point and working on my own writing.

I continue to think of money as a tool with which to accomplish certain things, and I have definitely come to value my time over money where possible and not excessive (grocery delivery is one of those things I go back and forth on!)

I love my job and I always assumed I would work for a long time. My grandmother worked into her 80s. My husband and I plan to pay for our 4 children’s undergraduate educations. It all adds up. We live in a small house in a fantastic school district so I feel like we are maximizing our dollars there. We also really focus on experiences as opposed to things when it comes to spending. But our food bills are INSANE! Teenage boys can empty a fridge in 2 minutes flat. We are trying to reduce waste, eating less meat and eating out less to counter this, but the volume of food our family of 7 can eat is astounding.

We are also starting to really focus on teaching our kids about finances. My 14 yo has his first job (refereeing youth soccer) and is making really money for the first time. So we are talking more about saving, investing etc.

Aldi rocks – check it out! Start with a few things and go from there. In our house we love their chicken strips in the red bag (frozen), frozen veggies, bread and rolls, milk, eggs, yogurt, cheese, nuts, baking supplies, cookies (especially the caramel ones that taste JUST like Girl Scout cookies), beef jerky, and even fresh meat.

Don’t forget your quarter for a cart.

Yes, Aldi is amazing!! My husband goes there first and gets as much as he can there. Their produce is also really good, like their berries. And their frozen blueberries are especially good. They are huge! We also get things like their Ahi Tuna from the freezer section. We get a lot of shelf-stable stuff there, too, like their cereal/granola bars, chips, etc.

I think people talking about money and how they spend money is so helpful and is a good reminder that different people have different money priorities, regardless of overall income, disposable income, etc. Similarly, just because someone makes a different amount than you, I think being open to others’ thoughts about money and spending can help you think outside your own money box or even affirm the choices you’ve already made.

I am not sure how long we will both work – probably into our 50s, maybe 60s? When we had an analysis ran by an advisor, it was more of a risk mitigation exercise because of the volatility of our industry/high chance of one or both of us losing our jobs and having a hard time replacing our income levels without moving (and moving is out of the question for us). I like my job and the assurance of a steady paycheck. I’ve always focused on the FI part of the FIRE movement, but not the RE part. I am very conservative in general, so I always use really low return expectations and recognize how unpredictable the markets are, and how long it can take to recover from bear market. So I would not want to retire early and stress about whether my nest egg will last until we are in our 90s. There is a lot of longevity on my side of the family. My grandma is 99! So I could live well into my 90s. Plus, if I retired early, I would have a hard time spending money on things like travel because I would worry I was depleting my nest egg. So I’d rather keep working and have the lifestyle we have – which is very modest IMO.

As far as expenses go, there isn’t really anything I want to cut back on. We are a very frugal couple. I also realize the privilege in our financial situation and never take it for granted, but we have also been very frugal and have focused on paying down debt while also contributing to our retirement accounts. Our biggest expense, outside of taxes, is childcare but it’s necessary and worth every penny. We haven’t spent much money in the last several years since we did very little during the pandemic and we rarely eat out. So I am hoping we spend a bit more in the next year or so on travel. I’m looking at resorts for a couple getaway in December and it’s definitely more expensive than the last time we went to the Caribbean, but still worth spending the money. Since 2018, we’ve gone on 3 trips w/ our kids and that is the extent of our travel, so we have underspent. But now I feel ready to pursue girls trips and to go away sans kids with my husband.

The inflation situation is really not going to hurt couples like us – we are very lucky to be able to withstand the increase in costs. It’s more something we will notice/comment on, but is not a source of stress for us. But lower- to middle-income families are really impacted by rising costs. There is a lot of data on household savings and how strong consumer balance sheets are and how consumers can withstand high inflation, but it’s probably really skewed by the higher income portion of the population.

YES. So true. This has to be insanely impactful for those with less margin and the choices to be made so much harder. I really really hope it slows down soon.

I’ve really started noticing the increase in prices at the grocery store but, as Lisa mentions, I have the privilege to be able to gripe about it and move on. But for people already existing with narrow margins this is heartbreaking. Especially with things like food, gas, utilities etc. Fundamental expenses that really can’t be trimmed too significantly.

We mostly try to spend as little as possible – we’re frugal and as entrepreneurs have had MANY lean years. A big priority has been paying down our mortgage quickly (despite several financial advisors telling us to take a different approach; I know Lisa has a similar approach, which makes me feel even better about this choice).

We’ve spent A LOT more on travel this year and I’m 100% okay with that. Also renovations. The cost of labour and supplies is outrageous and I’m really struggling with the sticker shock. There are all things that really needed to be done (and we’re improving some aesthetics as we go)…but it’s unreal how much it costs to own/maintain/repair an older home!

Thanks for the frank conversation. I share your interest in experience as taking more value than a fancy house/car/clothes though we are about to do some big renovations after 12 years but I think they will make a worthwhile difference. And we can’t move for less plus I love our location so this feels like the right call.

I see I am also in good company with worn out academics here too! I am spending summer figuring out what I want to do next to help with this. A good part is saying “no” to excess committees and not following every great for learning but extra work for me option in my courses.

This week’s Everything is Fine podcast touches on some of these questions (as well as other weeks). Highly rec adding this listen to your rotation if you don’t already follow them. It’s billed as “a podcast for women over 40” and I love both the relatable and “wow my life sure isn’t like that!” parts.

I’m a worn-out academic staff member. The past two years have been BRUTAL. At my institution, at least, even the easy things have become difficult. I thought I’d stay in higher ed for life, but I’m really not sure anymore.

Have you listened to the Lecture Breakers podcast? I thought some of the episodes were really helpful in thinking about course structure – you don’t need to reinvent the wheel, you can just do X, Y, Z (low-prep activities).

I generally agree with spending moderately on “home stuff” (including both mortgage expenses and stuff like decor, furniture, etc.). However, we just did a (modest, but still expensive) kitchen renovation and so far I consider it “worth it” (all relative, I know). We were able to pay cash and the increase in functionality and happiness from using an improved space has been really nice. With two young kids we spend A LOT of time at home and in the kitchen.

I loved the Everything is Fine podcast this week and the discussion on how things have a cost beyond money. It really made me think about how much I want to keep pushing in my career if I’m stable now and usually enjoy the day-to-day. I know I want one more step up, but beyond that, maybe I’m good? Hard to tell right now.

I would love to retire (or at least go to part-time) in my mid-50s, while I have the health and stamina to do fun things, like travel internationally. Honestly, I’m only 41 and sometimes feel very over having a professional career, but can’t really see myself cutting back now when I’m trying to build a nest egg for retirement, kids’ college, etc.

We do care about home stuff, and I never regret money spent there. Having a home environment that I love is important to me. So we’ll continue our spending in this area, and if all goes well, we’ll have the mortgage paid off by the time our oldest kid goes to college (in six years, holy cow).

I have reached the “experiences, not things” stage of life. I want to make sure we do at least one nice family vacation every year, and nearby mini-trips when we’re able. We are pretty budget-conscious travelers, though, and I struggle to justify the expense even though it’s what I want to do. I don’t know if that makes any sense! I did not grow up in a family that traveled, both because of financial reasons and lack of interest, so I think that’s where those feelings are rooted.

Lots of our neighbors are doing social memberships at local country clubs, mainly for the golf course and pool and social aspects. I have zero interest in doing this. The YMCA pool works just fine for us, haha.

Our kids are not in super-expensive extracurriculars, though we do splurge on summer camps, both for childcare reasons and because we want them to have those experiences and foster their interests.

I do not care about continually updating cars and techy things. I have adopted the buy less/buy better mantra for clothing. I love a good bargain on kids’ clothing, though.

I have started thinking a lot about the ability to travel (especially internationally) when I’m physically able and this may mean a tradeoff like you suggest – retiring early or at least going part-time. My parents didn’t start REALLY traveling extensively until their mid-60s. They are now in their early 70s and have a very limited number of people they can travel with because everyone else in their peer group is essentially too sick/not physically fit/has some other limitation. A friend of mine who is a PT says she often hears from her clients how much they planned to do after retirement but then were unable to do it for various reasons. I don’t want to be that person! So we have tried to prioritize travel and trips – both with and without kids – while we can, even if that may mean working a few more years. Luckily we both get loads of PTO from work (though the workload doesn’t lessen so honestly this is also a tradeoff and a stressor since I’m overloaded even without taking time off…).

Luckily, I care nothing about some of the expensive self-care things, like mani/pedis, massages, facials, expensive makeup and skincare, etc., so very little money spent there, and our house is paid off. On the flip side, I do have a bit of a shopping habit…though the thrill for me is the finding of a secondhand deal so I guess that’s at least more environmentally-conscious (and certainly cheaper than buying new!)?!!?

I hadn’t thought about not having a peer group to travel with, but that makes a lot of sense. One reason why I try to prioritize exercise and health now. I REALLY struggle with the tradeoff of work vs. travel. I have enough PTO, so that’s not the issue, but my issue is the work piling up while I’m gone. The prep- and follow-up work to get away has definitely kept me from booking vacations at times (even though I know that’s insane and not healthy). Bottom line is that workplaces make it really hard for people to live their best lives!

@Ashley, I cannot agree more. I love taking vacation but it is stressful to be out of the office for as much PTO as I have. Using PTO doesn’t mean that someone else does the work – it just means I do it in a shorter and more stressful timeframe!! If anyone has solutions for this, I’m all ears…

In my office, we deliberately structure workloads to have at least two people assigned to work on every program area so that someone can take leave without coming back to a crushing workload. My immediate office has a huge travel culture and it comes from the top down – people will readily take 2-3 weeks of leave. And there’s no grumbling about it when you’re impacted by someone else’s leave because you know you get the same in return. But this is of course a management level decision. From the perspective of an individual, if you have a crushing workload and you always have too much to do, isn’t that the case regardless of whether you take leave? So maybe just take the leave anyways and enjoy the break from your crushing workload. As a manager, I always like to remind people that we can only do what we can do with the resources available to us, so if they want us to meet an unreasonable deadline, I tell them we have to have more resources.

I honestly love when you write about finances and the like and LOVE reading the comments. I wish we were a bit more open to talking about finances, because sometimes you just don’t know. I honestly never thought I’d fully retire until I physically couldn’t do it anymore OR I found a passion project that requires me to work full time. For example, one of our family friends retired in his early 60s. He always loved photography, but never had a chance to do it, so finally devoted some time to learning it and buying professional equipment. He’s now created a fulltime business with this and is extremely well known in our community.

However, I do think I’d significantly cut my hours and/or ensure I have enough flexibility to do whatever I want to at that point. I worked with a Urologist who was working well into his 70s, his experience was extremely valuable to the department. However, he definitely took a lot of time off, every single vacation, and then usually a month off during the summer months. It seemed like he had enough time to spend with his kids and grandkids. I loved that set up.

Chiming in as another academic. I felt like I started so “late”, with my first postdoc at 32, my perm academic job at nearly 37. But I keep reminding myself that by 50, my son will be out of the house, and I’ll have another decade/two left and things will be fine (or the world will be burning… but I can’t control for that one).

My husband has a much better pension than I do (albeit still public sector, so not massive), and is 4 years older, so maybe by my early 60s I’d want to retire and do things with him?

We make much lower salaries in the UK, but don’t have to worry about healthcare costs and (at least currently), university tuition fees are waived for Scottish students. So I feel like we haven’t been as diligent about savings, hoping to save more once we stop paying nursery fees (2.5 more nursery bills!). We spend on travel – but my parents live in Portugal so that’s our default and fairly cheap – just the plane ticket, some meals and treats, decent food (a mix of meal kits and Aldi), and books.

I honestly can’t even imagine retiring! I do automatic contributions to my retirement account (and my employer has a nice match), but even in my late-30s it still feels so far away and unattainable. Hopefully I will be pleasantly surprised, ha! I don’t see myself wanting to fully retire much earlier than is “typical,” but would appreciate the FI to make choices about my career (position, hours, etc.)

I always find it interesting how so many people highly prioritize travel. I used to (pre-kids), but right now it mostly sounds unappealing. My kids are 5 and 2 and travel still seems SO HARD and not particularly fun. I am enjoying them still being at the age where doing local stuff is fun and exciting (pool, waterpark, museums, special events, etc.). Young kids are so delighted by some of these “ordinary” things and they are just easier logistically for us right now.

I just want to validate that your feelings about travel right now are COMPLETELY understandable. There is nothing wrong with sticking close to home now and waiting until it’s just easier. Because travel with little kids is anything but easy, and the tradeoffs aren’t always worth it!

I should also clarify (that at least for my own comment above) that my desire to travel includes WITH (to certain places for certain activities) and WITHOUT my kids! They are 3 and 6 and it’s just hard – my 3 year old still naps, carseats are a pain, etc. So we take them to places that we can drive to (instead of fly) and that are more ‘simple pleasures.’ But my husband and I also have a bunch of places we’ve gone and want to go without kids and do prioritize the funds/time to do these things. We are very lucky to have local grandparents to make this possible!

We are planning to take the kids to Europe in 2024 (they’ll be 8 and 5) to meet their German cousins. Hoping they’re old enough to enjoy and remember it by then!

We are in a similar boat, Stephanie. Our kids are 1.5 and 4. We live in Minnesota so have prioritized going somewhere in the spring to escape the cold, but our trips are very low key. We went to the Tampa area of Florida twice and then to Tucson, AZ to visit my sister this past year. We stay in VRBOs and don’t really do much besides enjoying being outside without so many layers. The beach trips were our favorite since we didn’t need to go anywhere to be entertained – the beach and condo pool were entertaining enough. But besides that, we have not traveled much. Pre-kids, we traveled quite a bit but it’s so different once you have kids. My parents have graciously offered to watch our kids this December so my husband and I can get away. If they weren’t willing to do that, we would not go on vacation. We definitely lean on local activities and likely would not do plane travel if we didn’t live in the cold Midwest!!

I’m in the same boat regarding kids’ ages and travel. We took a weeklong trip to the beach last month and it was so challenging that we actually walked back plans for other trips in the next few months. They’re just as happy at the (free! Local!) playground.

We really spend the most on housing. This is not because we want to be fancy but because we want to live close to my husband’s job (so he has a short commute) and give both kids their own bedroom (so at least half of us can sleep through the night).

Also, total splurge – I bought a roomba on prime day. Tonight my kids will throw food on the floor and then my new robot servant will clean while I relax…

I think one of the reasons I am so excited about travel is the kids are finally at an age where it’s at least somewhat fun. And I also am recognizing childhood is short! A goes to college in 8 years ????

We are about your age and it is disappointing to see our stocks and portfolios drop but our financial advisor keeps reminding us we are a long way from retiring and this a the time to buy and invest so we’re focusing on that. I feel like we do a good job not spending on frivolous things but we do spend money on experiences and camps for the kids. I’m slowly decorating our house. We’ve lived here for almost 5 years and I definitely take my time picking out furniture or even picture frames and plants. I got an electric car a few months ago and we took a big road trip and only spent $200 charging it. That has been life changing. Now we’ve planned shorter drives to see family we haven’t seen in a couple years. Covid has reminded us we need to get together more often, especially since I lost an aunt and uncle early on in the pandemic.

Should have also added, we prioritize spending on: childcare, house/physical environment sometimes (see kitchen renovation!), medical expenses (both kids have dental issues and we do regular therapy for multiple family members– even with insurance coverage it is expensive), and then saving for retirement/rainy day/potential job instability

I haven’t read the other replies yet, but one thing I think about is the age difference between my husband and I. I think Josh is a bit older than you as well. My husband is 7 years older, so if he retires at 65, I would want to go at 58 to travel and relax with him and our friends his age, maybe staying on PT (though I don’t get a full pension until 63, so that throws a wrench into things). I also remind myself that I won’t have a mortgage payment or kid camps/childcare or a car payment or student loan payments then, which drastically lowers our budget, especially if we can rent out our house while we travel. I’m only 40 though so it’s hard to think that far ahead. Until then, we max out our ROTHs, pay into my pension, and pay down debt early as able.

The past few years have only made me even *more* determined to retire early. My partner and I think our mid 50’s is possible, but we’d both retire TODAY if we could. Neither of us hate our careers, but we don’t love them and would much rather spend our one wild and precious life doing something else. If I won Powerball today, my boss would probably find a “I’m out, Peace!” post-it on my monitor and never hear from me again. I work in higher ed. My partner is an engineer.

Health insurance is the piece of FIRE that we have not figured out. Both of us have some chronic but okay as long as they are managed conditions, and a lot of the health care/insurance/insurance replacement suggestions in the FIRE community are not practical for our particular reality. We are both in our early 40’s.

Add me to the list of people that love when you talk about finances! I find it fascinating to hear how people make things work, what they prioritize, and life goals. I wish more people would be more open about it, but also understand what a sensitive topic it can be.

We focus on the FI aspect of FIRE. The goal is to get cash flow through investment properties to a place that we can live how we want to live (mostly travel) on then manage those from wherever while we have more time to build other businesses we have in the back of our heads.

Freedom of time, experiences, and food/health are our top priorities, while things like home design, clothes, and toys are fairly low on our list.

PS: When will you be at Universal?! We go at the end of July!

Early august!!! Oh man so close 🙂

My loose goal is to retire within at 60, plus or minus a year or two. I always assumed I’d go to 65 but watching my parents (who are in their early 70s) over the last couple years have given me pause and has me recalibrating my expectations. They are still in good health, still reasonably active, but at the same time are starting to slow down dramatically. A few physical issues are starting to enter the picture, more accommodations need to be made than they used to require. I had a conversation with my dad recently where he told me that my grandparents sold their boat, around which they had largely centered their retirement, at age 72 because it was getting to be far too much for them to maintain. I didn’t remember it that way at ALL, I would have sworn they were MUCH older when they finally sold it. As someone who always thought that the 70s were the absolute picture and pinnacle of a healthy and active retirement (if that is what one wants), I now believe I am wrong — it is one’s 60s.

My parents retired at 60 and I’ve always assumed I would do something similar… they’ve spent the last 12 years traveling and enjoying volunteer opportunities and all the things they couldn’t do while raising kids and working (or at least 10, before the pandemic). That said, my husband’s family has a family business that he will most likely take over once his dad is no longer able to manage it (still going strong at 74 and his grandpa worked until he died in his late 80s)… so I don’t think that the true retirement like my parents have is in the cards, but we are setting ourselves up to be able to retire from our “traditional” jobs within the next 20 or so years.

I loved reading this!

In general, we live pretty frugally given our income level (or at least we save a good chunk of our income). I definitely watch expenses such as grocery expenses (and even notice the price increases at Aldi, which I LOVE), but we are not really impacted by this fortunately.

I do want to get out of our miserly tendencies a bit in the next few years. As our kids get a bit older (youngest is 3), I would really love to go “all out” on some big family trips while my kids are at good traveling ages. We also want to do a decent sized home addition…the idea of spending the $ makes me so nervous, but logically I know it will be a great thing for us and we can afford it. It is so interesting to hear how others approach this!

I also find all of this fascinating, especially when people include their priorities. Not that I usually get jealous when reading about things people spend money on, but it certainly helps to put things in perspective when you’re reminded that the writer places a high value on x and doesn’t spend much on y.

It’s funny, I used to value travel a lot and now I don’t as much, or at least not the big travel. I live in New England so there are lots of great driving trips available, stretching up to Canada and down to probably DC for us (our personal car ride limit is about 8 hours). This is partly due to having a 3-year-old and a baby on the way, but I started to shift my thinking even pre-kids. I like nice trips but would be happy with a plane-ride trip every other year, and I’m not sure it factors into my retirement plans as much as I once thought it would.

I also have been thinking that I may entirely change careers rather than retire early, as has my husband. And we might shift in our 40s or 50s.

I have seen my parents, who are both in their early 60s and plan to retire around age 65-67, start to decline physically somewhat in the last 3-5 years. I would say my mother takes fairly good care of herself and is generally healthy but just has some random issues and my father is less healthy and also has some random issues. This has also been a big impetus to me to prioritize my health and fitness and to carefully consider what retirement might look like for my husband and I.

We have a reasonably priced home and do not buy new cars, tech stuff, etc. either. We do prioritize taking care of our home and some aesthetics, childcare (which for us is also very reasonable, but about to get more expensive as we’ll have to hire a nanny while we wait for a spot to open up at our daycare for Baby #2), and experiences. I do like nice stuff so sometimes I spend more but not as often. For me I find that high quality things in areas I care about prevents me from feeling wanty all the time.

I definitely think the question of how many active healthy retirement years one has is an important one. I love my work and I work flexibly enough that it doesn’t really preclude doing much so I’m not too concerned with what I could do when “retired” or “not retired.” But I think for many people, assuming that those healthy active years will extend well into their 70s is just a guess. As a previous poster said, your peer group might start having enough health problems that they can’t participate in the fun. Or your spouse could have health issues that would both preclude certain adventures and possibly require more hands-on caregiving. It’s really all just odds and hard to know.

As for travel, at one point I was telling myself oh, it doesn’t matter if I don’t travel as much now because I can spend my entire 50s doing active leisure travel if I want, since I had my first three kids at 28, 30, and 32, so they’d all be out of the house then. Then I had two more babies, which could theoretically push the travel years forward another decade, but I decided I didn’t want to count on that — best to start traveling with the kids. It’s a hassle sometimes but not terrible. Sometimes I travel just with the older three kids (we’ve done Yellowstone in fall, Disney, and Paris together!). We’re putting together an ambitious travel schedule for the next year despite having a 3-year-old then because even if it won’t be perfect we don’t want to keep waiting.

This really resonates with me — we have a big age gap in our family (10, 7 and … 16 months) — just as our older kids were getting old enough that we could look forward to some really memorable travel, we had another baby. I guess he’ll just see the Grand Canyon at 3! Like you said, we don’t want to keep waiting. Childhood (life!) is short.

YES, Amy! We also have a 7-year gap between our last 2 kids, and we are just sort of dragging the baby along for the ride.

I absolutely love travelling too. We are in Hawaii at the moment on a trip that was originally planned for 2020. I am not terribly frugal by nature but Hawaii’s prices are really stiff and have even forced my naturally spendy self into googling “cheap Oahu activities”.

I love my job and have no desire to retire early although maybe I would want to do part-time when I am older (i am 40 now).

Many of my favorite memories with our kids are from our vacations and I feel like it is a good priority for us

We spend quite a bit of money on travel as well…to the point that we likely won’t be able to retire until our early-60s. Honestly, making memories with my kids now is far more important to me than being able to take it easy when I’m older. I witnessed my own parents health decline almost immediately upon retirement and therefore, retiring doesn’t have the same appeal to me that it has to some. I see myself working part time in some capacity as long as I am able.

I’m in the same boat with you here. Agree with everything you said!

Same here, things I won’t cut down includes travel, family experiences, quality food, kids activities (learning or sports), learning expense such as books, self growth physically and mentally (running, meditation or subscribed podcasts). Things I don’t mind spending includes car, brand bags, but I do prefer quality clothing as I get older, I realized they make me feel cared everyone I wear them and functionally better too (lululemon for example), restaurant foods, household items in general (I just buy store brand).

I have been thinking more about where do we want to retire rather than when. The more places we live the more I realize the vast option of places we could choose.

Because we have a small house for a large family, we prioritize giving the kids amazing experiences and making sure they have cars to drive (teens! Yikes!), can play whatever sports/ do whatever activities their hearts desire, etc. I also never skimp on food and prioritize convenience over cost in basically every area of my life. I guess comfortable living is my priority across the board. I am an academic and love my job so much it never feels like work. I have an amazing pension but am in no hurry to retire because my job doesn’t impact my freedom to travel or live my life in a flexible way. Thanks for this opportunity to reflect— it improved my mood.

We set our financial priorities annually! I can’t have everything all the time, but I’m optimistic that there’s a time and place for everything I want and value. Our first year out of grad school the top financial priorities were building our emergency savings, building professional wardrobes and saving a pot of money to buy furniture (because we rented a very nice furnished apartment our first year). Our second year, we prioritized a home downpayment. The third year it was buying and decorating our home. The year after that it was international travel – after multiple years of travel being low priority, we went on three big international trips in one year. And came back from the last trip and shifted our focus to preparing to have a baby. Another year it was replacing both our cars, and then another year it was a couple of expensive house projects – installing a/c and replacing the oil heat in our 98 year old home. This year it’s therapy and also saving for our upcoming home reno.

Prioritizing experiences over things has certainly been trending of late, but I’m kinda pro things. Because frankly, many of the things we prioritized earlier are things we’re still enjoying! Like I’m sooo glad we prioritized buying a house quickly over say, travel, when were starting out. The equity upside has been huge and we got to take advantage of historically low interest rates (and we moved to a wonderful community sooner and began building strong relationships sooner. DC is so transitory that the relationship piece can be hard). Likewise, we’re still actively enjoying the home decor we prioritized five years ago, and have only had relatively nomimnal expenditures on home decor since then. And OMG, every time I walk into my air conditioned house or look at my winter heating bill, I wonder why we didn’t update those systems earlier.

We have some longstanding priorities, where we recognize that we may spend more than is average or strictly necessary – food and clothes in particular, but also other things health related (a membership to both a neighborhood yoga studio and an office gym, regular massasges and acupuncture, etc) – but they aren’t budget busters that preclude us from prioritizing other things. But the process of identifying our big ticket one time priorities each year and knowing what our less expensive but everyday or recurring priorities goes a long way towards rarely feeling like our spending is out of alignment with our values and needs tweaking. But the one thing I will say about groceries – we’ve been buying fewer items lately because of the quirks of keto cooking, and because I’m finally calming down on my pandemic induced overbuying, but the amount we are spending is holding steady due to inflation. The prices on some of our key staples have really been crazy.

So-I am on the other side of the equation-mid-60s and semi-retired, Looking back, here is what helped me:

1. Stay the course. You don’t have to strive for perfection, and things that seem insurmountable can get better over time. When I was in my mid-30s, I went through a divorce (with 2 young kids). I was in a profession (law) that paid well, but I worked less than full time, There was not a lot of financial wiggle room. When the head gasket in my car died, it took me 6 months to pay it off. It was scary at times, but I hung in there and things got better. My setbacks ultimately made me stronger and wiser.

2.. It’s never too late to start saving. I barely had anything saved for retirement at age 35. I had (foolishly) cashed out my federal government retirement funds in my late 20s to buy a car. I started adding to my 401(k) little by little, and am now at a point where I feel very comfortable walking away from work. I maxed out my contributions as soon as I could.

3. Take the time to educate yourself about your budget and your investments. Before I got divorced, I did not take the time to focus on our finances, so I had to get up to speed in a hurry once I was on my own. A deer in the headlights attitude is…..not wise. Since I remarried, my current husband and I always get together to go over current bills and overall investment strategy. Stay informed.

4. Both big and little economies can add up over time. We buy quality new cars, and we drive them into the ground. I’ve been the proud owner of several cars that were still growing strong after 200,000 miles. I also get a kick out of small economies. Free Slurpee Day at 7-11? I’m there!

5. I got interested in the travel points and miles “hobby,” which has provided us with some amazing vacation memories. One recent example: I used Hilton points to book a 5 night stay at the Waldorf-Astoria in Chicago. We got the room for free, had breakfast included, and were upgraded to a 2 room suite with gas fireplace and balcony because of the Hilton Honors Diamond status provided by my Hilton credit card. Cost of the stay: nothing! Of course, this only works if you never carry credit card balances.

6. Think carefully about college savings for your kids. We saved consistently for college for our 2 kids-but we opted to have them take out Stafford loans as well. Kids can borrow money for college, but you can’t borrow money to retire. We made sure that the amounts borrowed by our kids would not unduly burden them, and stayed far, far away from parent PLUS loans and other private loans,

7. Take time to breathe! We often get so bogged down by the demands of work and kids that we forget to take time to appreciate the simple things. Time goes by quickly.

8. Look around for free or low-cost stuff to do as a family. Particularly in the summer, there are lots of free offerings by counties and towns. We went to a free jazz concert in our area tonight-lots of people with picnics and bottles of wine. it was great to see lots of kids there playing tag and dancing around.

I agree that this is fascinating! I’ve never given much thought to retirement beyond beginning to save for it very early. Hubby and I are pushing late 40s with a teen and a pre-teen and will likely always be responsible for our youngest. We have funds set aside for both of them.

Pre-pandemic we were just hitting a place where we could travel more easily and that imploded for three years. I do hope to add it back to our lives soon, but the drastically higher costs are hard for me to get past. In addition, we made some lifestyle changes during the last few years that have made it harder to leave home. I’m having a hard time with this, as it really wasn’t my choice. (Livestock-related.)

We had been traveling with my parents and they’re certainly not getting any younger.

I remain hopeful that the costs settle a bit over the next 4-6 months, not to mention all the extra logistical headaches in the industry.

Making a commitment to myself to begin planning a spring trip. It’s time, even if it costs a lot.

Going back to re-read comments – so much great info/advice!

My family is in the middle of our first “staycation”. We recently had a big life transition so we couldn’t do a big vacation this summer. We blocked out time off work that would be just for our family and did all fun local things we don’t usually do. And ate out each night. It has been so fun, really relaxing to be in our own house, and no airfare or hotels!!! I think this is a great option for school breaks, you just have to rebrand it into a staycation.

@Margot – how nice. Did you find it hard to “power down” when you were surrounded by visuals of “I should” tasks? When I consider a similar concept my mind fills with all the higher effort chores that could be tackled – like a deep garage cleaning, for example. I suppose if planned well, it would be doable for both approaches. We’re not good planners. 🙂