Books Finished in February: a very non-fiction month for me!

Usually my balance is about 2:1 novel:nonfiction. February featured mostly non-fiction (and really mostly personal development!). I know it’s a genre that many despise but . . . I don’t 🙂

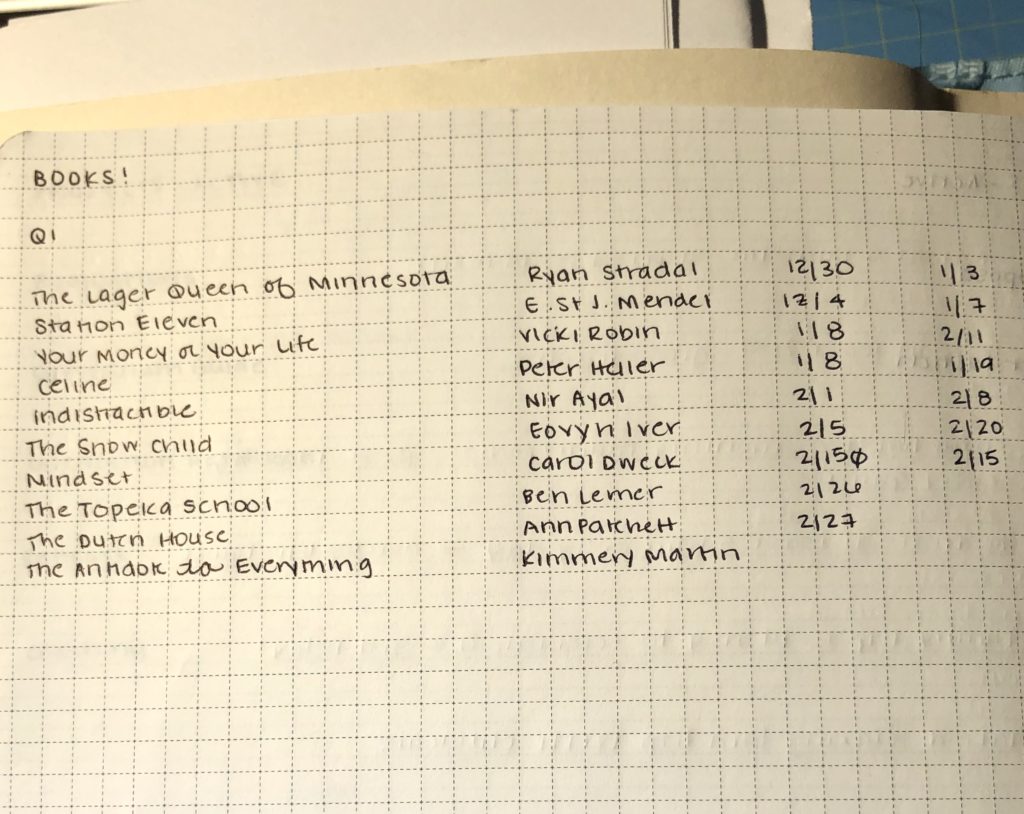

1- Your Money or Your Life by Vicki Robin – finished 2/11. The overarching ideas in this book are interesting, but I found the ‘methods’ over the top (and I’m someone who can get into a method!) and the language a bit too ranty for my taste. At the same time, it was interesting to see how the concept of FI evolved decades ago. Much has changed and much has remained the same (spend less, earn more, you can be free, etc).

2- Indestractable by Nir Ayal – finished 2/8. This was a quick read and a bit forgettable, but I did enjoy it (and felt it had some valuable takeaways) while I was reading it. That said, I think I like Cal Newport’s books on this topic a little more. I also hate that this particular topic is usually addressed by men who seem to have more freedom to shut themselves off from outside inputs.

3- The Snow Child by Eowyn Ivey – finished 2/20. Perfect winter read, and I really enjoyed the process of reading it (though I would have preferred a different ending!!). Living somewhere with no winter, books like this give me a seasonality that I crave, and the landscapes and winter “feeling” are captured well in this novel set in Alaska.

4- Mindset by Carol Dweck – finished 2/22. An unexpected ‘add’ to my Q1 list for parenting book club! I actually really liked this book, which was published ~12 years ago and has become a bit of a classic. I have really tried to change some of the language I use for praise around the kids, and it opened me to possibility. There are a few too many repetitive vignettes for my taste, but I felt like the concepts were valuable enough that this wasn’t a deal-breaker.

Currently most of the way through The Dutch House and loving it.

Allowance Spent in Feb!

Restaurants: Offerdahl’s ($14.37), Starbucks ($6.64), Buca Di Beppo for a work social event ($35), Happea’s for lunch with a friend ($12.78), Starbucks again ($4.23), Starbucks yet again ($5.78), Panera delivered to office ($20.93)

Total = $99.73!! woah and oops. I’d rather not spend that much of my personal allowance on restaurants. Will try to cut that total in half for March!

Boring calamities: Dr Phone, to fix phone screen because I dropped it (and had never bothered to put on a protector, $88.80) + library fee ($1.25)

Total = $90.05

Fun things: Mani / pedi ($54), Silk & Sonder journal ($18), 2 Natori bras ($133.38), returned 2 bras from January (+$136.96), Mindset from above (didn’t have time to get from library so ordered, $11.22)

Total = $79.64

FEBRUARY TOTAL SPENT: $269.42.

26 Comments

Thanks for sharing your “allowance” spending- I love the nitty gritty breakdown and appreciate your transparency! Curious, if you go over or under budget in a given month, can you add/subtract from another month in YNAB? I haven’t figured out how to do this yet. Thanks!

Also just started Celine and loving it.

If you are under budget YNAB automatically rolls it over, so it stays in your allowance bucket! They used to have an option where you could overdraft a single category and subtract it from the next month but they got rid of it. I wish they would bring it back. It is the only thing I would change about YNAB!!

I just finished reading Indistractible too. I also felt there were some good takeaways. I especially liked the concept of viewing distraction as anything that takes you away from what you want to/ are supposed to be doing in that moment. I find I can ask myself when I get the itch to do something that I shouldn’t (at that time), “What are you actually wanting to be doing right now? Working? Okay, then it’s not the time to google XYZ…” Haha 😉 I like how he applied that not only to work but also to things like spending time with a child or doing the dishes- if that is what you said you would do in that moment, then don’t disrupt it to check your phone or send an email!

What part of the eating out would you cut? It seems like lunch with a friend and a work social event are both very worth doing!

The Starbucks and panera!

3 coffees in the entire month seems totally reasonable though!

I agree! Even though I talk about cutting my almost daily habit of getting a Starbucks coffee, I still do 3 or 4 times a month. Which I think is reasonable and something I enjoy as I usually sit for a bit when I do go and do some planning or meet a friend.

Maybe you’re right 🙂 $100 just seemed high!

The thing that happens when I spend on small stuff like coffee is that it seems to start this cascade of spending on…whatever! I’m a moderator when it comes to eating but a abstainer when it comes to spending due to this snowball effect.

I hadn’t chimed into earlier posts about the blog when you were thinking about the direction of it. I have to say I love the conversational tone that you bring and it is just right and what keeps me coming back. That’s why when you mentioned also the state of the world – I feel like we do need to think of what we express out into the world but also it is a conversation about what is real. Not about what is going on from an “expert” perspective but an everyday how you are feeling as well. It’s a place to have conversations and I love it! Even though I really don’t get into the conversation enough myself.

It is so easy for restaurant and coffee spending to add up. I was in a bad habit for awhile of grabbing a coffee from Starbucks on my walk from the bus to my work. Then one month I added up how much I was spending and was shocked. I know bring a double-walled travel mug of coffee with me every morning! Thank you for the willingness and openness to bring up lots of different topics!

Do you count date nights in your restaurant budget or is that a separate category?

Separate category 🙂 that’s our general “restaurants” budget that includes all family eating out, takeout, dates. Which we did well in for Feb actually something like $370. For us that’s quite low!

Idk I think your meal spending is really quite reasonable! I also was not a huge fan of the ending to Snow Child, but it was still a great read. Maybe I should track this myself, though I fear what it will show. My Amazon addiction is real. ????

I also thought your meal spending was very reasonable. I was thinking it was incredibly low as i know you like to do date nights but then saw in another comment that you have a separate budget for that. I let myself get one coffee/week and I splurge on a latte so it ends up being $5+ usually. But I got a ton of Sbux gift cards so it’s not hitting my mint account for the next several months. My restaurant spending has been much higher lately between friends’ bdays and my bday and other things but I am just letting it go as there are months when we barely eat out, besides my monthly book club meal.

Love the naming of the “boring calamities” category! I really need to put a screen protector on my phone. I will be near apple store this afternoon and will just pay to have them do it there – it’s annoying to go and pay, but even more annoying to pay $80+ to fix it later, as I’ve had to do at least twice before.

“I also hate that this particular topic is usually addressed by men who seem to have more freedom to shut themselves off from outside inputs.” YES so much this! I’ve started, and stopped, listening to productivity podcasts by men because so many of them are so tone deaf to the realities of working parents. Yes, I’d love to ease into my day with 2 hours of reading/reflection/Gregorian chant/an elaborate coffee ceremony, and yes, it must be so nice for you to be able to do that, Male Productivity Guru With No Kids. Let me reflect on that as I once again try to get my ADHD son to the bus stop on time without either of us losing our minds and get to work reasonably on time. 😀

OMG this! I’d like to see a behind the scenes look from their wives – ‘It’s awful but he’s such a whiny baby if he doesn’t do it that I just put up with it?’ or ‘I’m plotting to leave him, I call my lawyer while he’s meditating’.

Echoing with ACDALAL said. Was it Cal Newport who essentially seals himself in a stone tower for hours at a time to write, without any interruptions, while his spouse tended to the house and kids? I’d also like to see some more working women in the FIRE space, to discuss the costs and benefits of child care.

Ms Frugalwoods, to her credit, just did a blog post about how she changed her mind (since writing her book) about childcare and is now happy to be paying for PT daycare for her 2-year-old.

This amount seems quite reasonable to me. (I work from a coffee shop every morning and often eat something, I never did the maths to know the exact monthly amount spent at that coffee shop…)

When I started working more, I told myself I could spend as much on Starbucks, fancy exercise classes, and expensive yogurt as I want. It’s liberating to have these mostly guilt free pockets of joy!

I got the flu in early February and I am FINALLY catching up on life, including podcasts and blogs of course 🙂

I just ordered Vicki Robins book so it was good to read your review. I’m curious to see what all the hype is about. Along the same lines, thanks for sharing your spending! Food is always my weak spot. Groceries, convenience foods, dining out, coffee, ALL OF IT. I’ve gotten waaaay better in 2020 and would love to keep it consistently below $50/month this year.

$500/month? Or $50/month for extras?

My goal is to keep dining out to $50 a month or less. My “allowance” was $200/month but I’ve been on a FI kick and I’m trying to spend the minimum amount possible while not feeling like I’m denying myself. Starbucks is definitely one pleasure I don’t mind indulging in. Money well spent- my coffee at home never tastes as good!

Ah initially i thought you meant $50/month for all groceries. That would be challenging!!!!

Ha! Yeah, I’d venture to say impossible- best we’ve been able to do is about $450/month for our family of four (2 grownups, 4 year old, and very picky 2 year old). Our savings figure is about 20%, but I didn’t think to include my employers retirement contribution, I like that approach and it makes sense.