Well.

I mean, is anyone really surprised!?

What a crazy thing to wake up to.

This year honestly does not feel real. I *hope* that there will be a time in the future that feels more normal, when I can read my 2020 blog posts with my mouth open at what a crazy time it was.

(I am now picturing 80 year old me reading theshubox and it’s a rather funny but possibly prescient vision.)

4 more on a Friday

1- Yes, I contributed to Gretchen Rubin & Elizabeth Craft’s podcast Happier (around the 27 minute mark)! Semi-anonymously though so it wasn’t quiet as thrilling as my Mom Hour moment. The best part was that several of you alerted me of this (and I did find out from a reader before I heard myself which was quite thrilling!). Guess there are not that many pediatric endocrinologists with kids ages 2 (though now close to 3!), 6, and 8.

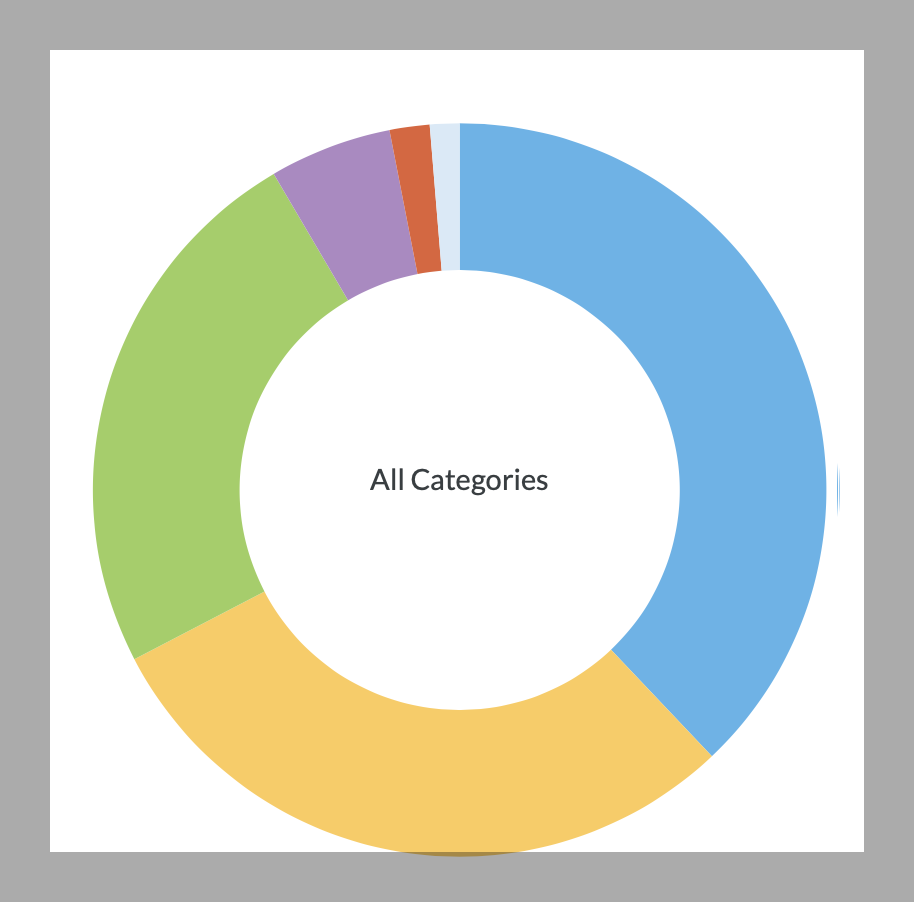

2- It’s budget day! I am trying to figure out how previously owed (and now paid/prepaid) taxes should be counted in our expenditures. Want to see something fun? Here is a graph (sorry, no numbers, just proportions) showing our expenditures thus far in 2020. This is theoretically “post-tax” $ (ie, the total is what has come home in our paychecks, after normal withholdings/deductions).

The blue is taxes (as I’ve mentioned, we owed for 2019 and prepaid extra for 2020 — both were paid out this year so are reflected in this graph). That is 37% of our “spending” (!!!), but taxes aren’t really spending – they shouldn’t be counted in take-home pay in the first place, right?

The green is boring monthly things like rent / utilities and the yellow is kid-related including our nanny, college savings, and school/activity costs — there were some activities the kids were doing before the pandemic hit. The purple is “fun” costs though this year it has included some travel costs that won’t actually result in any travel so were not all that much fun. The red is restaurant + entertainment + streaming services. And the light blue is blog/podcast related costs which should probably be separate but . . . they are on the graph because I track them in YNAB along with everything else.

I have really been trying to better understand our spending & focus on savings goal this year but I have to say that giant tax slab makes it less intuitive. (Next year will be more clear as we will be withholding much more from the get-go with hopes of avoiding these lump sum payments!).

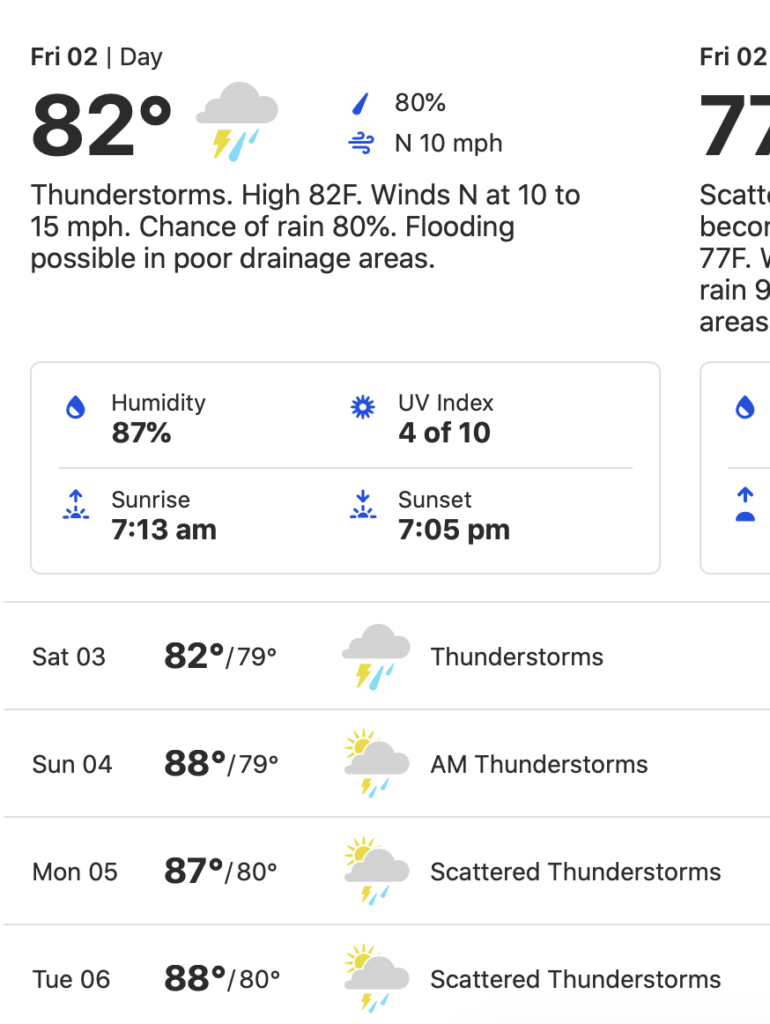

3- I’m officially jealous of everyone with nice fall weather.

Every year I hate this time of year, weather-wise. I know I just have to be patient. December is usually nice . . .

4- I am now reading Red at the Bone by Jacqueline Woodson. It’s so good; I’m sure I will finish it this weekend. I realized that we also had a children’s book of hers out from the library: The Day You Began! Genevieve really likes that one.

5- I found out yesterday that A’s teacher will not be returning to the classroom even though schools are set to open for in-person learning in mid-October. Online learning will continue for everyone anyway, so this means Annabel will either be in some other random classroom with headphones on, placed in a classroom with a teacher’s aide serving essentially as babysitter or possibly placed in the cafeteria (which sounds terrible, honestly). I told her she can go for 1-2 days to investigate and if it turns out that being home was better/more comfortable, she’ll just go back to fully remote from home (makes drop off easier anyway).

This may be a hard decision for her to make because she misses her friends but honestly online school at home has otherwise worked well for her.

HAPPY FRIDAY. The weather is iffy so I am going to do the leg/plyo workout in lieu of a run this AM. Sad but a reasonable substitute!

10 Comments

Sarah, I hear you; I’d much prefer to prepay taxes and have (more than enough) taken out of my paycheck so I don’t owe a large lump sum at the end of the year. I’d rather not see that $$ in the first place.

I loved Red at the Bone!

Red at the Bone was gorgeous! It’s such a quick read but one that really stuck with me. Another book you might enjoy is Ann Petry’s The Street. It was published in the 1950s and was a really gorgeous but very sad.

Oof, those taxes look painful. We unexpectedly owed a lot of taxes the first year we got married, but we were able to easily cover it from our savings and still have ample savings left over. It was soon after we finished grad school when we had a ton of startup expenses, plus we hadn’t been working for very long. It would have been so easy to have overspent and not had enough savings to cover the taxes. I manage all our money on my own (as my husband has zero interest in money/the very idea of it stresses him out so he avoids it), and I was super proud and happy that I had done a good job managing our money and we were able to handle the huge unexpected expense in stride. My feelings were ultimately positive about the situation, even though I definitely would have preferred to keep the money in our bank account.

I was very happy we had enough to cover it, too!!! I had to lower my fantasies of having even more to put away for retirement, but that’s much better than not having the cash on hand.

Oh taxes. Our pie graph looks similar to yours each year. I do a year-end finance summary with percentages, not numbers. Interestingly, I got huge refunds before getting married. My husband wouldn’t owe much. Now we owe so much. I had no idea there was such a thing as a marriage penalty but he knew ALL about this because his other guy friends had warned him! But oh well! Our taxes are definitely higher here in Minnesota but it’s worth it because we have excellent schools, libraries, parks, trails, etc!

I listened to Happier yesterday and did not catch that you were the commenter making the veggie recommendation! Too funny! That was an interest segment and makes me look forward to the days when our son is a bit older. He’s 2.5 right now and so strong-willed so there is nothing we can do to force him to eat vegetables. Apparently he eats them in soups at school but I have a hard time believing it. If I cut up peppers and onions (pretty small) in a pasta sauce, he will fish them out of his mouth or pick them out of his food before eating. I guess I need to start really blending them into sauces or something. It’s maddening. But you can’t reason with a 2.5 year old. He also will not eat any fruit which is so odd for a kid! And he doesn’t like cheese either! So eating is very frustrating for us… I talked to his ped about it this week at his 2.5y appt and she said to just keep trying. he will eat anything in puree form but we only use those when we are on the go, besides applesauce which he eats with most meals since it’s one way to get a fruit in him (unsweetened of course).

And boy did I think “karma!” when I saw Trump and Melania tested positive. They have taken so few precautious. I just hope Biden doesn’t get it. he as in Minnesota this week and had some indoor campaign events… So i wonder how many people his campaign is going to infect…

Oh the taxes! I was a resident when we bought our house and due to some penalties we had to pay on some investments we used as a down payment, we ended up with a tax bill that was more than I made in that year! I still remember sitting in the chief residents’ office on the phone with my husband when he told me. That said we bought our house in 2009 and we still live in it, now relatively inexpensively, but that was a painful year.

The White Coat Investor blog seems to have some good stuff on taxes for high income people, those might be helpful to you.

Thank you! I love White Coat Investor but don’t currently subscribe- maybe I should.

I knew that comment was from you! I love when my podcast worlds overlap. Great suggestion, by the way, that I want to try with my extremely picky eater.