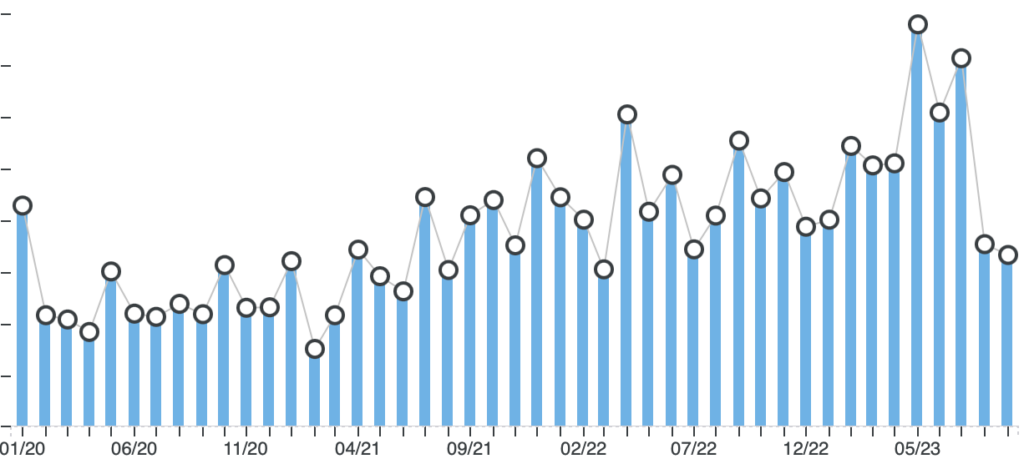

It’s the end of a quarter, so Josh and I did our traditional net worth calculation (super simple method, we just look up account balances and put them into a google sheet). It was not that exciting (slightly up but only because our home value increase offset the market softening) but then I thought a little YNAB trending would be interesting. And since I can cut off the raw values (I am not as brave as Kelsey!) I thought I would share.

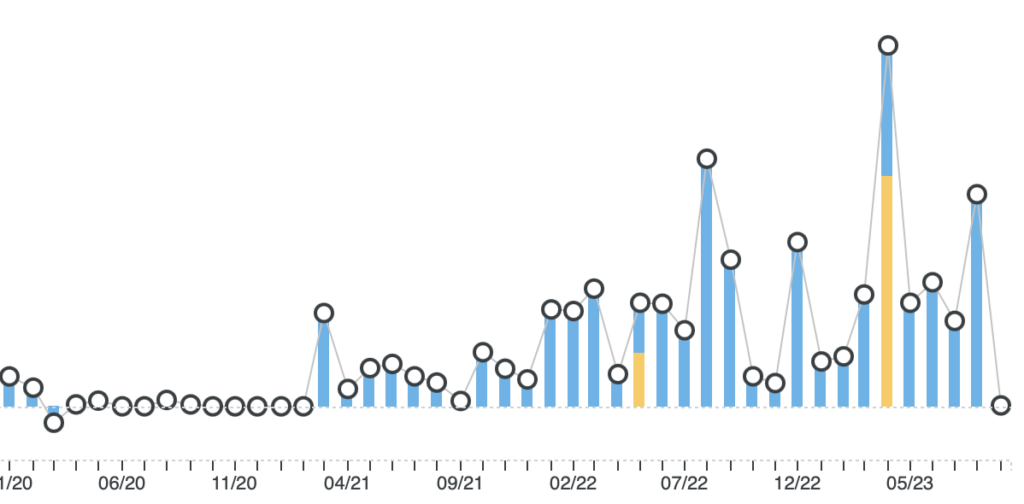

TRAVEL:

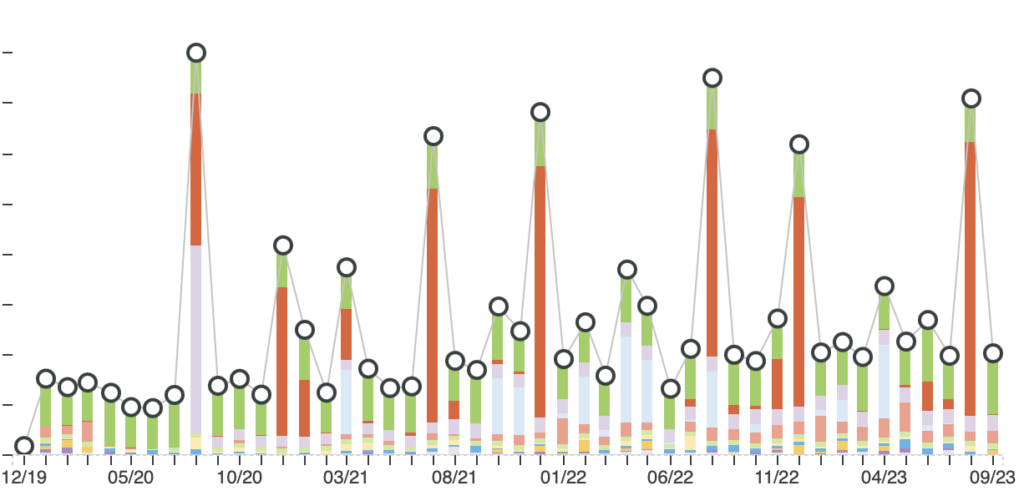

ANYTHING CATEGORIZED UNDER KIDS (from clothing to 529s to nanny to camp):

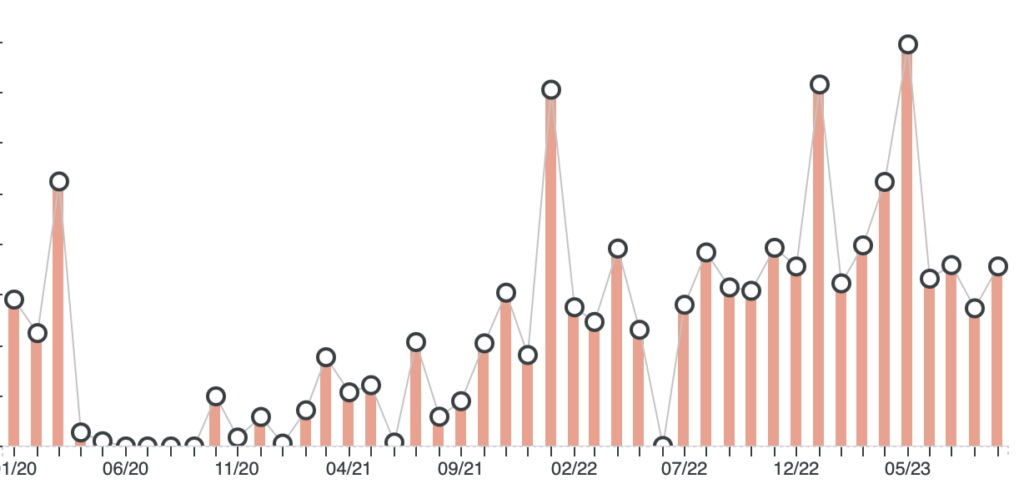

KID ACTIVITIES SPECIFICALLY:

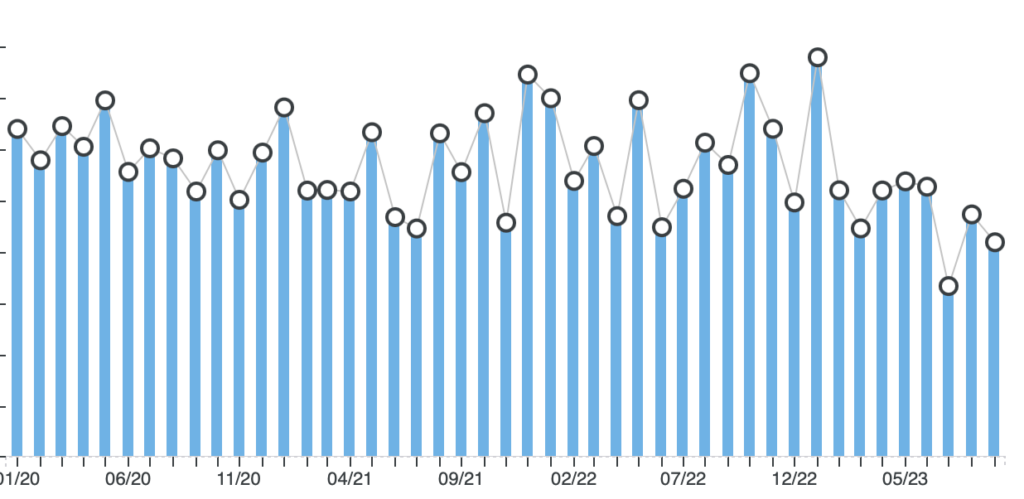

GROCERIES:

No. I discovered Trader Joe’s. Wish I had figured that out earlier.

RESTAURANTS:

Kids ordering from adult menus now definitely contributes.

I don’t have pre-2020 data because we were on a different version of YNAB (and I think there was a ~2-3 year hiatus in there too). But I am glad we have it now! Do I plan on any spending behavior change as a result of this review? Not really. It does make me want to avoid larger unnecessary purchases (new car for example) until we truly need them. Also, lifestyle inflation is real so I’m glad we have most of our savings pretty automated.

2 Comments

Well you had me at financial. 😉 I love this kind of stuff. I only look at annual numbers in terms of spending. There is seasonality to some of our spending so it’s better to kind of look at a whole year and compare it to the previous year to get a sense for how things are shifting. The 2020 spending is kind of humorous. That partially explains why our economy is still thriving despite aggressive tightening from the fed. There was so much money saved during the pandemic/pent up demand!

We do try to meet quarterly to look at our net worth and to discuss our investment plans for the next quarter as well as charitable giving. We missed Q2, though, but will definitely do our review in the next week or so. Overall I think our spending is pretty low compared to our peer group. That’s what a financial advisor told us when we met with one in summer 2020. I was like – can you say that again for the person in the back of the room. 😉 My husband would tell you we spend a lot of money but he is one of the most frugal people I know so it was helpful to hear that from an impartial 3rd party that looks at peoples’ spending all the time! But overall I feel like we are spending the right amount. And I know it will change as the kids get older and have more activities. I am thrilled that we will finally be buying a car in October – we ended up having to go with a Rav4 hybrid as there were no primes to be found in the Midwest. I’m very excited to have 4WD for winter finally!!

I think financial review is a value consistency review. As long as you are spending where your values are,

I think I’m happy about it overall. Mostly our spending goes to travel and kids activities, which according to die zero, it’s the moment to spend those. In 10 years, we won’t be spending on those.