Today is day #3 of call. It has not been busy. And I got to sleep the past 2 nights all the way through! However, I have still been mildly stressed and indulging in call-related behaviors such as scrolling more social media & eating more crap (although the product pictured below happens to be pretty much the most delicious thing I’ve ever tasted).

I also tend to be shorter with the kids & Josh during this special time.

But — only 5 days to go. I will give myself credit for engaging in some more positive coping mechanisms, including:

- taking myself out to lunch for the sole purpose of having somewhere quiet to read — ~30 minutes with my Kindle app in the middle of the day felt so refreshing & indulgent!

- going to bed reasonably on time — it appears my “summer hours” are going to be more like 5a – 10p, and hopefully we can get G sleeping until closer to 7 with a slightly later bedtime (!?)

- diving into my new Summer Reading List with gusto. I noted previously that it was aspirational, and I still think it is, but I’m actually moving pretty quickly! I am 80% done with Daisy Jones and the Six (4/5 stars thus far) and have started reading about 15 minutes of Digital Minimalism (too early for any sort of rating, but I like his writing style and premise so far) to start my mornings.

So, all of that is good.

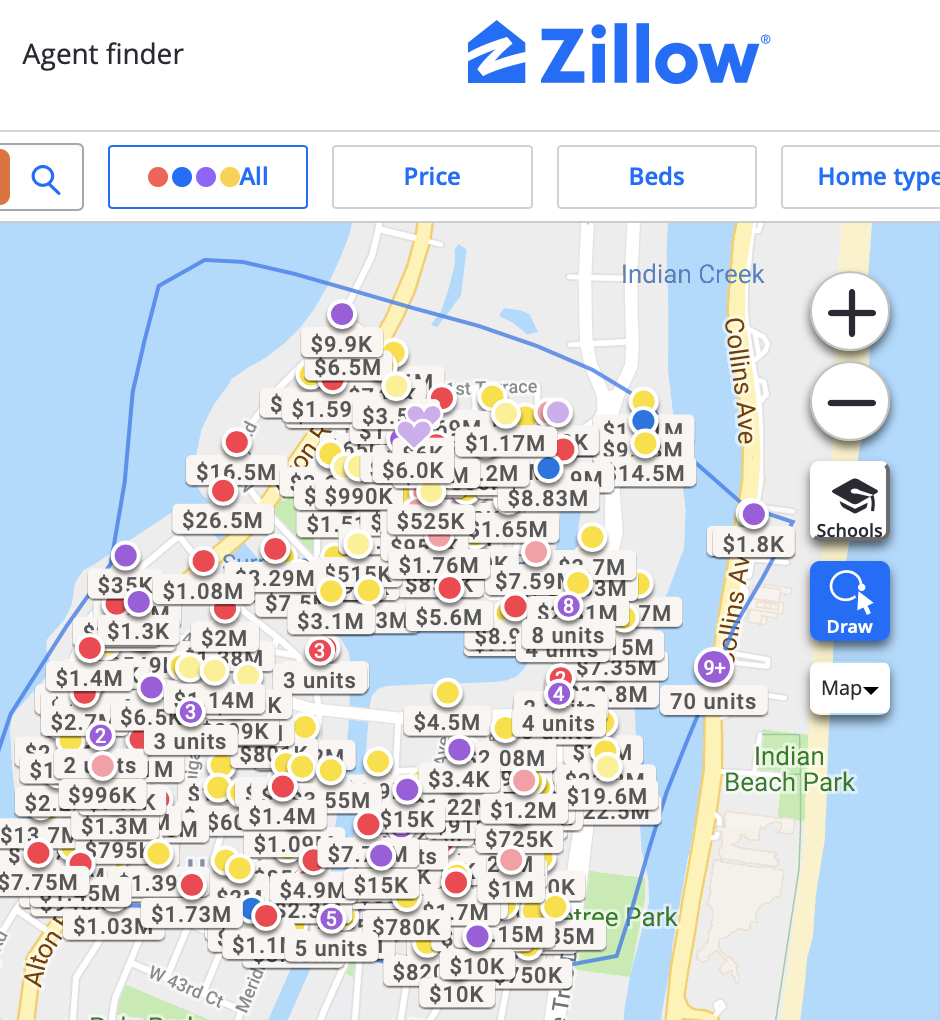

I have also been dwelling on our finances a lot. Because a) I have a newfound obsession with frugality/finance podcasts even though our lifestyle is . . . not exactly following many of the tenets discussed, and b) our house is still sitting there unsold. I actually am fairly surprised about b) because I loved our house and I think it’s priced quite reasonably (ie, one of the least expensive in the neighborhood). The market here is terrible though right now, and seeing the “on sale for 188 days” on Zillow yesterday was depressing.

We may end up renting it out, so . . . new side hustle for our family? Not one we really wanted, but perhaps it wouldn’t be so bad.

(I’d rather it sell, though!)

ON THAT NOTE — budget-related things — we are doing a podcast episode on free or low-cost parenting hacks! By popular demand, we’d like to feature strategies that aren’t as expensive as outsourcing your cooking or childcare. You can leave them as comments in this post, email them to me here, or post on our Instagram.

33 Comments

I just checked in here!thanks for doing these posts. I wait for them!

I live in New Zealand. Its 10pm Thurs here….so cool i get to see your post first!…. Lol

Would love to hear what frugality/finance podcasts you’ve been listening too! Sorry if I missed it in another post but could you please share? Thanks!!

Yes! I would love to know too!

Do you know why the market is that bad? (I live in a city where houses on sale go in 48 hours! It is crazy.)

I guess just supply and demand.

JEALOUS of your situation!!

Oh, too bad… Hope the best for you. Housing market is so difficult to understand and it can shift fast. Good luck.

I’m obsessed with Choose FI podcast. You should collaborate with them!!!

Oh man, our market is the exact opposite. We’ve been looking for a house for almost 2 years. Granted, we are looking in a very small area of Minneapolis but there is just nothing on the market and things that come on the market tend to sell pretty quickly. But the price in our area is MUCH lower! I’m in Minneapolis so average prices in our area are in the $500k range? I hope your house sells soon!

I am married to a minimalist and we are both super frugal so we don’t outsource anything, even though we could afford to… I really wish he would agree to hiring a house cleaner but for now we split cleaning duties and he has agreed we can hire one when we move into our larger forever home (our current house is only 1,200 sq ft so not all that much work to clean). We tried doing grocery delivery last fall but my husband didn’t like it so he does the grocery shopping now. We both have an iPhone so we use a note from the note ap (you can share notes with other iPhone users). That way we can both add to it. We talk over meal plans on Wednesday night and start building our shopping list so he can do the grocery shopping on Saturday morning. I only cook about 3-4 dinners/week and bring salads to work for lunches. I spend nap time on Saturday and Sunday chopping things for the recipes/salads I’m going to make that week so everything is ready to go when it’s time to make dinner. That’s been the biggest life saver for us as our evenings are very rushed. I get home at 5 with our son, he eats dinner around 5:45 and goes to bed at 6:30 and then we eat after he’s in bed. My husband usually feeds him dinner while I get our dinner started (we aren’t able to all eat together – maybe we will when he can stay up past 6:30?) and assemble my salad for the next day. So long comment short, the key to success for us is meal planning and prepping things ahead of time. Plus looking at the division of labor was the key starting point. I felt overwhelmed doing the meal planning, grocery shopping and meal prep. Now my husband contributes to meal planning (before he would not make suggestions about what we should have), does the grocery shopping, and watches our son if he wakes up and I’m still chopping things for our meals.

This is sort of a random frugal thing we have been doing, but we bought a hair cutting kit for around $50 and my two kids and husband no longer get haircuts at a place. It paid for itself after three cuts and now probably saves us about $80 or more bucks a month. It also saves time since rather than driving to a place, sitting there and waiting, etc. we can do it in our house whenever we want. It’s also been pretty fun! Probably won’t work forever as I think eventually the kids might want something more professional, but who knows. So far nobody has said they look weird 🙂

Same! I got super tired of paying $20+ for my son to get a hair cut (that frequently looks awful and choppy anyway) so we purchased a $40 kit online that came with two different pairs of scissors, all of the clipper accessories and is pretty good quality! Over time my husband and I have both gotten pretty decent at giving him hair cuts.

Yes the home haircuts can be a great money saver. My husband had done his own in the mirror with a hand mirror to cut the back for years. I got tired of paying for bad haircuts at the barbershop and bought a Wahl hair clippers set, a better than cheapie set, but not the $200 ones. I tried, got flustered and he took over. It was not my intention, but he is awesome at it and I get asked where I took my boys for haircuts as they are that good. Hubby has been cutting my hair for years as well. He says cutting women’s hair is actually easier than giving my boys their haircuts. Mine just takes longer as I have a lot more hair that takes longer for combing, sectioning, then trimming layer by layer. I would reasonable say it saves me over a grand a year by him being the family barber/sty. You can save a lot of money, but you need to be reasonable and understand that unless the one wielding the shears and clippers is got a knack for it, it can be a disaster. I saw a family in church one Sunday where the father and son both had absolutely horrific haircuts, uneven, shaved on one side and completely missed spots, and the daughter had her lovely all one length hair cut into ear to ear bangs that were way too short. I felt sorry for them as I know the mom did them and she had no clue what she was doing.

One often overlooked hack is not to buy a big car just because you have kids (especially two kids or fewer)! Lots of people in our area buy an SUV or minivan when they have kids but we have two elementary school aged children (and one small dog) and both my husband and I drive compact cars. We have saved thousands of dollars with this choice (lower sticker price of car, lower gas/maintenance costs). Granted, if we had a third we’d probably need to upgrade to a mid-size car but still wouldn’t get an SUV.

Other hacks: meal planning in advance so you can take only one grocery store trip each week and then force yourself to actually cook those meals and avoid takeout/going out.

Look into free festivals/community events/library programming. We rarely pay for local fun in the summer! I also recommend looking into city-run community centers/pools which often have tons of free programming and/or very low entrance fees. We even use our community rec center to work out; it’s only $5/month!

Join a babysitting co-op if one already exists in your neighborhood/daycare/school, or start one if not! Everyone contributes a certain number of hours of babysitting and gets those hours back in return for their own babysitting needs. Or do one informally with friends who have kids roughly your kids’ ages/stages. Babysitting is expensive!

Hand down your baby stuff/kid clothes to others and find others to do the same for you. We rarely buy kids’ clothes because we get so many hand-me-downs.

Ooh love these! We do have one SUV (highlander hybrid) for when we have family visiting but I also have 3 car seats in the back of my Prius – it works great with the narrow Diono Radian seats!

Don’t buy expensive clothes for young kids! So many of my friends “invest” in very nice clothes for their children with the rationale that they’ll use them as hand-me-downs – sometimes for a sibling who doesn’t exist yet! But babies and toddlers don’t know how to maintain their clothes, and many of them get stained or torn or lost. The rest might or might not fit the next kid, or suit his/her needs, and storing clothes for years has its own problems. So I buy inexpensive clothes for my toddler (which seem to hold up just fine), keep the ones I want to keep, and throw out or give away the rest. I’m definitely saving money now, and I’m not convinced I’m spending any more in the future.

Not a frugal tip, but I enthusiastically recommend the Hatch Baby Rest if you want your toddler to sleep later. It’s a very simple toddler clock that you can control from your phone. I started my son with it when he was 16 months old and was sleeping less and less each week, until he reached a nadir of waking at 4 a.m. (we were all miserable). After just a few weeks he was consistently sleeping later and napping better. These days, the clock is set to turn green at 7 a.m. and he usually wakes up sometime after 6:30 and plays quietly in his crib WHILE I SLEEP. It is toddler-mom heaven.

Interesting about hand-me-downs. As a mom of 4 including 3 boys, I use hand-me-downs heavily. I don’t invest in pricey tee shirts or sneakers. I do spend a little more on jackets, dress clothes and dress shoes and shorts (no knees to make holes in) because all will make it through 3 boys wearing them. Plus I hate the waste of tossing things out.

My kids wear a mix of expensive-ish clothes bc it’s a true pleasure of mine and totally free hand me downs. I have one wonderful friend in particular w 2 girls that loved to buy Tea Collection, Biden, GAP etc and we have been lucky enough to get their hand me downs!

Costco everything. We heat up the food in oven with delayed start option (I work at 2pm, so will stick pre-cooked Costco meat to warm up and ready for my ravenous kid at 5pm with dad) and roast a veggie almost daily (also in the same oven)

We do a big shop every 2 weeks and get another fruit or veggie haul in between. We don’t make extra grocery trips.

Also a fan of pre-loved toys for kids (fb marketplace). We use to buy preloved clothes but now my kid can wear it for a whole season so ok to just buy new (one seasonal haul, usually online)

We use library a lot. Also science museum membership with reciprocity so when we travel we get to visit other museums for free (astc passport) and other local memberships do we have free activities for friends and family who visit (we buy a larger family pass for the zoo and the garden because we have grandparents visit often)

Most of those memberships are tax deductible donations!

Our local gym has “parents night out” which is cheaper than in home babysitter for date nights.

We do outsource lawn and housecleaning.

Parenting hack: We’ve been rocking playdate swaps. Saturday mornings we’ll watch host another family’s kids for a few hours in exchange for dropping ours off the next weekend. Win-win: the kids LOVE it, and you get a free quarter of a weekend in return! We also do the same thing with our kids’ Friday movie nights – host other kids some weeks, and go out for no-babysitter-required happy hour the weeks our kids are somewhere else 🙂

There are certainly people more frugal than me, but one thing we save considerably on ( without sacrificing fun I think) Is vacation spending. We don’t do lots of big week long trips to exciting places… My kids are young enough that we take a longer weekend trips to more low-key destinations. We have done one week long trip once (Disney) but otherwise keep things really low key. We are going away later this month for 4 days and I’m guessing we’ll spend around $1500 all in. That is not frugal at all to some people, but I feel like it is pretty frugal compared to other people in my social circle. ????

I love the frugalwoods blog, and her book. So many good ideas.

Yes I can’t wait to hear that podcast!! Where I live (in Canada) houses are selling for around $750 to 900 000 and we just can’t afford to go that high!

We live in a much smaller home than average (1,000 sq. ft. with two young kiddos), move infrequently, drive our cars for a long time, usually eat at home and primarily vacation to visit family (located in all four U.S. time zones + Europe, so fun places to visit!). We get to travel internationally each year, but it is relatively low cost since we stay with family.

We do choose to live in one of the many expensive areas in the U.S., send our kids to one of the best daycares in the area (paying more than our mortgage) and enjoy the convenience of being able to walk to everything. I think it is important to choose your priorities!

My frugal tip is lunch dates for date night (my husband has a lunch hour, I have a flexible schedule some days, we work near each other). Kids are already in daycare + lunch specials + no/less alcohol is much easier on our budget.

I seriously love this idea!

Parenting frugally is a mindset. When I think about what brings my kids joy, it’s pretty easy. A new park to visit, baking cookies, build a birdhouse. Most of what they demand is time from my husband and me. With my little kids, i accept the pace of life as slower (or I try to… some days are tougher than others). I also think that genorosity is key to frugal parenting. A single, childless friend was between leases. I offered her our house for a couple months. It was so much fun and the kids were delighted. She offered childcare in return – everyone was thrilled. We pay for grandparents and other family to visit – cheaper than flying our whole crew to them!

On a practical side, I plan and cook all our meals, my husband does all home and car maintence, and when we spend money, we do so thoughtfully and in a way that brings value. Our zoo membership, for example, has a low cost per use because we go frequently. We also try to spend lots of time in nature – no spending opportunities in the middle of the forest!

Absolutely agree about a frugal mindset. Well said!

We’ve gotten a lot of benefits from being members of a synagogue, including saving 10% on our kids’ preschool tuition by sending them to the synagogue’s preschool. We do have to pay membership dues, but they’re worth it to us for the community (and the preschool discount is a nice added benefit!).

We live downtown where we walk to work, school, and most of our recreational and extra-curricular activities. We save a great deal of money on transportation (and time). We do not have room to acquire as many consumer items and consequently save money because we live in a relatively small home.

The public library is a wonderful and free resource. Each haul of books keeps the kids entertained for a good stretch of time.

We meal plan and prep on weekends.

If you have an Aldi… it’s amazing! Very cheap groceries.

Freezer meals is an absolute lifesaver! Start by just making a double batch of your favorite when you have a bit more time and pulling it out on a busy night. It sometimes takes a bit longer to double but basically never takes twice as long, especially for things like casseroles. The website onceamonthmeals.com lets you pick a menu, and even gives you a grocery list and instructions to do one big cook day. I’ve done that a few times but found I prefer a few ‘larger’ cook days than 1 huge one. A few tips:

1. Only freeze meals that are big hits/favorites. If you didn’t like it that much the first time you’re not likely to pull out the leftovers frozen a second time.

2. Look for recipes that are made to be frozen. While I’ve literally frozen just about everything recipes designed for freezing definitely have an edge. In general add a bit more liquid as stuff dries out in the freezer. Also slightly undercook pasta/rice so it’s not mushy when reheated.

3. Focus on meals that are already cooked and think about how you want to reheat. Mini foil pans are great for the oven or else plastic is easier for the microwave.

Meal Plan! Even with stuff in the freezer my brain is much at 4:45pm when the baby is crying. When my fridge list already says “enchiladas” I don’t have to think I just throw it in the oven.

Love these tips!

Kids clothing strategies:

Keep at least 2 bins per child of clothing – ‘too small’ and ‘next size’. I try to keep at least one size ahead in Goodwill/thrift store/hand-me-downs. So my kids is currently 4T moving into 5 and I’m picking up 5 and 6. I only buy ahead in thrift store or hand me downs. When we get into that size I then take a look and fill in around the edges with any needed new items. (e.g. It got warm and we discovered we have pants and shirts but not enough shorts ). Thrift stores work better if you go often without much of an agenda. If I have a few min in the neighborhood I’ll poke my head in. Then when I see a great deal (next winter sized ice skates for $2!) I buy them and put them aside. I’m lucky enough to have a big basement with bins of kids stuff but I realize this might be harder in a smaller space.