The Episode:

My Current Monthly Review Process

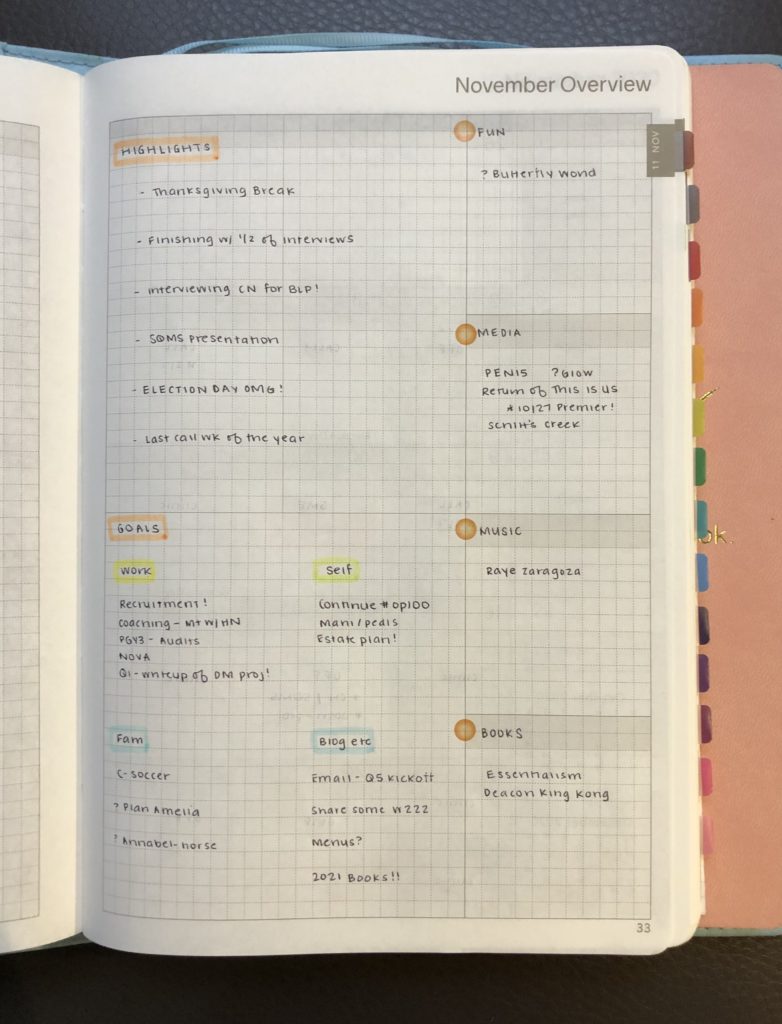

S1: Review Prior Month’s Goals (in planner) and All Lists in Apple Notes

take a moment to celebrate any successes

think about things not accomplished and whether they deserve to be forwarded, tabled, delegated, or deleted

S2: YNAB audit & setting new month’s budget. Usually first Friday night of the new month. That’s how cool I am.

note: for efficiency, it definitely helps to have 2 screens!

go through statements + make sure no transactions missed

create next month’s budget based on anticipated paychecks (that is the fun part!)

S3: Review any Big Events upcoming with husband

lately, there aren’t many! But maybe someday there will be again.

S4: Set Action Goals for the month

ie – what do you want to get accomplished in each realm of life?

I separate into Work, Self, Family (which includes my husband), Blog/Pod

S5: Think about any habit goals to focus on for the month.

Lately, I’ve been mostly focusing on Op100 but it could be anything!

Maybe it’s wakeup time, a workout goal, bringing your lunch, PLANNING every day . . .

S6: Look ahead 60 days and obtain any needed childcare

So much easier to get babysitter committed in advance

(Really not as applicable post-COVID! But likely will be someday again.)

(S7): Reminder to look at library holds list & make sure it’s up to date with what you want to be reading!

18 Comments

Question about YNAB. I put almost everything on my credit card. Can you pull that info easily into YNAB? My credit card also attempts categorizations too and I’m curious if that would pull in. I could try this on my own, but thought I’d ask and maybe save myself a bit of time!

Milly, my credit cards pulls into YNAB. The categories don’t, but once you set it for one thing, it remembers for you (like Wegman’s is always “Groceries”).

Gotcha. Thank you!

Yes! I use YNAB and download my credit card statements and bank statements and import them into YNAB. It’s very easy if you save the statements in .qfx form. I think you can also automatically sync but I doesn’t like connecting my accounts to other programs. Once you’ve designated your electric bill etc. it will remember the categories, but for me it doesn’t use the credit card category guesses. Fortunately, after a month or two of entering categories it is very good at guessing where you want things. I don’t enter anything as we spend (it’s more for long term tracking) and it just takes 20 minutes or so to import the statements each month, check over the automated categorization, and sort the few transactions it can’t figure out. Payments to our city all have the same payee but get different categories so I always have to manually sort those, for example, but it doesn’t take long at all.

Thanks for answering bc I don’t do this! I like entering transactions as they happen and doing my check doesn’t take too long. But great to know this is an option!

How does that work when the credit card statement dates are all different?? I’m assuming that in YNAB you would record the expense as you spend it. But obviously, CC statements run across multiple months typically (not 1-31st), so how does the system know which charges to include? Or does it actually pull the dates? Many times at the end of the calendar month, that month’s current charges aren’t even on a currently closed out CC statement yet. Does that make sense? This always confuses me with these programs, handling credit cards.

YNAB pulls the dates from your statements (and often order numbers or locations, whatever is in the statement). I load the most recent statement, then there’s an option on the credit card website to load all transactions since the latest statement to get the rest of the month. YNAB will recognize and ignore duplicate transactions so you don’t need to worry about loading the same transaction twice. I also wait until the 5th of each month or so to make sure everything has processed.

I think it speaks highly of the program that I use it in a very different way than Sarah but also love it. You can really adapt it to your needs.

hi, came here to say that YNAB can definitely pull in all your transactions from both your bank and your credit cards. Yes, you have to “trust” them, but I love it as I see immediately what has hit my credit card, and also can look at my budget every day to know how I’m doing (if I want…). This is particularly good toward the end of the month, or when I have a big expense like a car repair I didn’t expect and have to reallocate. I know what really has money left and what doesn’t. Also, in terms of entering vs. having pulled in – you do have to approve every transaction and assign a category if it doesn’t recognize the vendor as someone you’ve had before, so it’s not that it’s sight unseen to you.

Hi! I’m a big fan of listening to how you and Laura make your Goals list every year for every quarter/quintile and it’s motivated me to do it as well! Every year I have a “resolution” that just gets broken or not accomplished, and I realized I needed to be a bit more specific. I wanted to ask you – how do your monthly goals fall into place with the quintile goals you’ve set for yourself?

Another great episodes! Short and sweet but you packed a lot in. We don’t do a monthly finance review (we use mint) but we sit down as a couple every quarter and review our finances/investments and figure out if we need to make any changes. Super romantic date night – ha! 😉

I feel like the W222 system is so perfect for this process. I’m tempted to get one for 2021 but I still have so much room left in my current bullet journal so I am going to be patient and wait until 2022 to a new planner system. I think 2021 will be a weird year for planning with me being on mat leave for the first 1/3. But maybe by the 2nd half or final quarter we will be able to plan date nights again, schedule babysitters and get together with friends/families?? Fingers crossed. We went on maybe 2-4 dates/year so it’s not a huge sacrifice to not go on date nights, but I miss having the option!

Hi Sarah, question about YNAB. I’ve been using it to allocate money to categories as it comes in. In other words, I give a name to every dollar currently in my account. When I get paid, I go in and increase my budget dollars until all dollars are budgeted, then as I spend the categories obviously go down.

I didn’t realize people can (and do) use it to plan for the whole month. To do this, do you just overbudget each category? So it looks like you’ve budgeted more than you have?

I don’t know if I explained that well enough to make sense. Lol

Ahh 🙂 So the way I do it — I put all 4 of our upcoming November Paychecks in as Nov 1 (even though they come later in the month – we both get paid every 2 weeks). I know they are coming and I know approximately the $ amounts, so I feel safe doing this (plus we have plenty of buffer anyway in checking / high yield savings). Then the total shows up right away and I can budget every dollar! If additional $ comes in, I’ll add more to certain categories (like podcast/blog stuff).

Ahhhh ok I see. That is more manageable with manual entries. My transactions go in automatically, but I suppose I could either a. overbudget based on anticipated income or b. Manually add income at the beginning of the month then back it out when the paychecks go through my account.

Thank you that helps clarify!

Ummm…maybe this is way too nosy, but what does the first line in the “Media” column say?

Yes, I want to know too! It looks like a word it cannot possibly be

it’s Pen15 – it’s a show on Netflix I believe?

It’s a tv show! PEN15 🙂 and it is hilarious and disgusting

Haha!! Well, that makes sense, now! The “Glow” that was after “Pen15” looked like “Grow”, so I was super confused…